The mortgage industry is moving towards digitalization, and there are excellent growth prospects. In the US alone, the mortgage industry market size was valued at $11.05 Trillion in 2020.

Market growth looks promising for mortgage lenders. But, as a loan officer, do you have the right technology to scale operations?

Without mortgage CRM software, it gets difficult to be efficient at loan pipeline management.

Mortgage CRM is the new way to increase productivity while improving customer satisfaction and reducing the paperwork burden on the mortgage broker. It also makes sure there are no errors of memory or misplacement.

These platforms are customizable and scalable — mortgage professionals can manage all of their customer relationships from one place without having to switch back and forth between multiple business software.

CRMs can also help mortgage professionals offer a personalized experience for each client based on their attributes, preferences, and online behavior, while still offering all the standard services such as loans, mortgages, credit cards, checking accounts, continuity programs, and more — all within one CRM system!

In this blog post, we will look at the top 10 mortgage CRM functionalities that can benefit your mortgage lending business today.

Table of Contents

Top 10 Mortgage CRM Software Functionalities

Let us ask you this. Have you ever been unable to locate a document from a huge pile of paper lying on your table, especially when it was urgent?

At mortgage and banking firms, this happens every day.

Luckily, there are software tools for digitizing paperwork and automating most of the daily business processes, including mortgage marketing.

Any decent CRM software with cloud data storage can help you reduce manual work and improve your loan pipeline management, which in turn helps improve both revenue and customer satisfaction.

Here’s a list of features to look for in your mortgage CRM software.

1. Document Management

Paper documents can easily get misplaced or damaged.

This can result in heavy losses for businesses. Mortgage professionals can easily avoid such issues by digitizing records and converting all the paperwork into electronic files.

A mortgage CRM will keep your loan documents secure with two-way authentication sign-in. In fact, many advanced solutions give admin control to restrict the access of the loan documents based on users’ roles and responsibilities.

All your loan documents are stored in a cloud server that syncs in real-time with all your devices. Access those files from anywhere using any device with an internet connection.

And if you delete a file by mistake or your system crashes, you can easily restore all your loan data within 30 days.

Related blog: Mortgage CRM: Why Loan Officers Need a Specialized CRM Software

2. Regulatory Compliance Management

If you want to avoid hefty fines or penalties, you need to be up-to-date with the ever-evolving industry compliances.

The best mortgage CRM offer integrated compliance modules that keep your business in line with all rules and regulations, such as the Federal Housing Administration (FHA).

The system automatically gets updated with any modification in the existing standard rules. It works in the favor of both parties, by reducing risks and red-tape, and hence increasing sales.

3. Loan Management

A mortgage CRM system acts as a centralized platform for all your data. This means you will find all information related to your customers and their mortgages — their current status, amounts, etc, in one place.

With mortgage CRM integration functionality, lenders can connect their CRM with the loan originating system (LOS). All data such as loan status, Residential Loan applications (Form 1003), etc., is synchronized easily.

This way, you can keep track of loans and generate reports in real-time. A CRM tool ensures smooth loan process management.

4. Mobile Responsive

In this era of globalization and remote working, easy access on the go is a must-have.

Since the mortgage industry is time-sensitive, many tasks require immediate attention regardless of your location. It makes access to your CRM from outside the office quite important.

Besides flexibility, mobile responsiveness enables companies to shrink their office space and save on Opex without disrupting operations. Mobile-compatible CRM software will ensure that you can easily access the dashboard from your smartphone.

Not just access, it should enable you to take actions like creating tasks, generating reports, responding to customer queries, and more.

This will ensure effective use of time by all the mortgage professionals, increasing overall productivity and also customer retention.

5. Electronic Signature

Real estate mortgage lending can be a time-consuming process. The borrowers have to print out forms, sign them, scan them, and then send them in for the mortgage lenders to even begin their work.

But today, the whole mortgage lending process has become easy — thanks to mortgage CRM. With eSignature functionality, any mortgage company can easily convert these forms into PDF format and have them digitally signed by the client anywhere, anytime.

It can be done in a matter of a few minutes and does not require in-person visits. The Covid-19 pandemic has taught sales teams the importance of electronic signatures and safe, secure document sharing online.

Advanced mortgage CRM tools can extract information from the online forms and automate all the data entry for you.

Also read: A Quick Guide To Email Signatures and Best Practices For 2021

6. Lead Management

Without an excellent lead generation tool, you won’t have many new clients. We know that lead management isn’t easy, especially if you are doing it manually.

You need to engage with your leads at the right time to increase the chances of conversion. A CRM system can help with a whole suite of tools to carefully nurture your leads and build long-lasting relationships.

The system automatically collects data for efficient contact management, based on lead attributes and online behavior. Our all-in-one CRM software EngageBay even predicts the chances of converting your leads.

It keeps a record of every interaction with your leads so that you can pick up right where you left. You can also set up automatic reminders for follow-up calls to further enhance your contact management.

7. Marketing Automation

A CRM system is the best software tool you can find to successfully run marketing campaigns and attract customers with the help of marketing automation.

Most importantly, it helps you define your buyer’s persona and segment your borrower audiences by various filters. It’s crucial to send out targeted messages at regular intervals to nurture customer retention.

For your mortgage lending firm to thrive, you need to have a solid outreach program in place. And that begins with a good CRM system, capable of automating your marketing tasks, like drip email campaigns.

EngageBay’s powerful marketing automation helps you automate all your marketing campaigns effortlessly.

Having a strong social media presence is equally important as sending out a newsletter. You need an online reputation management tool integrated with your CRM to monitor what is being said about your mortgage lending services.

A good brand presence online is a prerequisite for successful customer relationship management. Good thing is, most marketing automation tools like EngageBay offer social media management tools as well.

When customized for your mortgage business, these mortgage CRM systems can help spread your brand awareness tremendously.

8. Integration and Scalability

A unified CRM ensures the easy flow of information between applications, allowing companies to make smart decisions, fast.

Your mortgage CRM software should be able to integrate with other business apps seamlessly. It could be any system, like ERP (Enterprise Resource Planner) system or LOS system.

You also need to ensure that your mortgage CRM system can be scaled for use when your business grows. When looking for mortgage CRM, ask questions like: How many users can I add? How many contact records can I store?

Having to change your CRM software every time your business expands can be a waste of time and financial resources.

👉Wait, what is a CRM database? Learn everythning you need to know in our expert guide! 💪

9. Credit Scoring

Mortgage lenders need technologies that can help them make credit scoring faster and accurate while enhancing overall operational efficiency.

Go for a mortgage CRM system that comes built-in with credit decision-making features. If not that, it should at least be able to integrate with major credit reporting platforms to carefully gauge your customer’s credit score before approving any mortgages.

This will help automate the process of generating offers and analyzing borrower qualifications. This is a crucial stage in mortgage processing, as it helps mitigate risk.

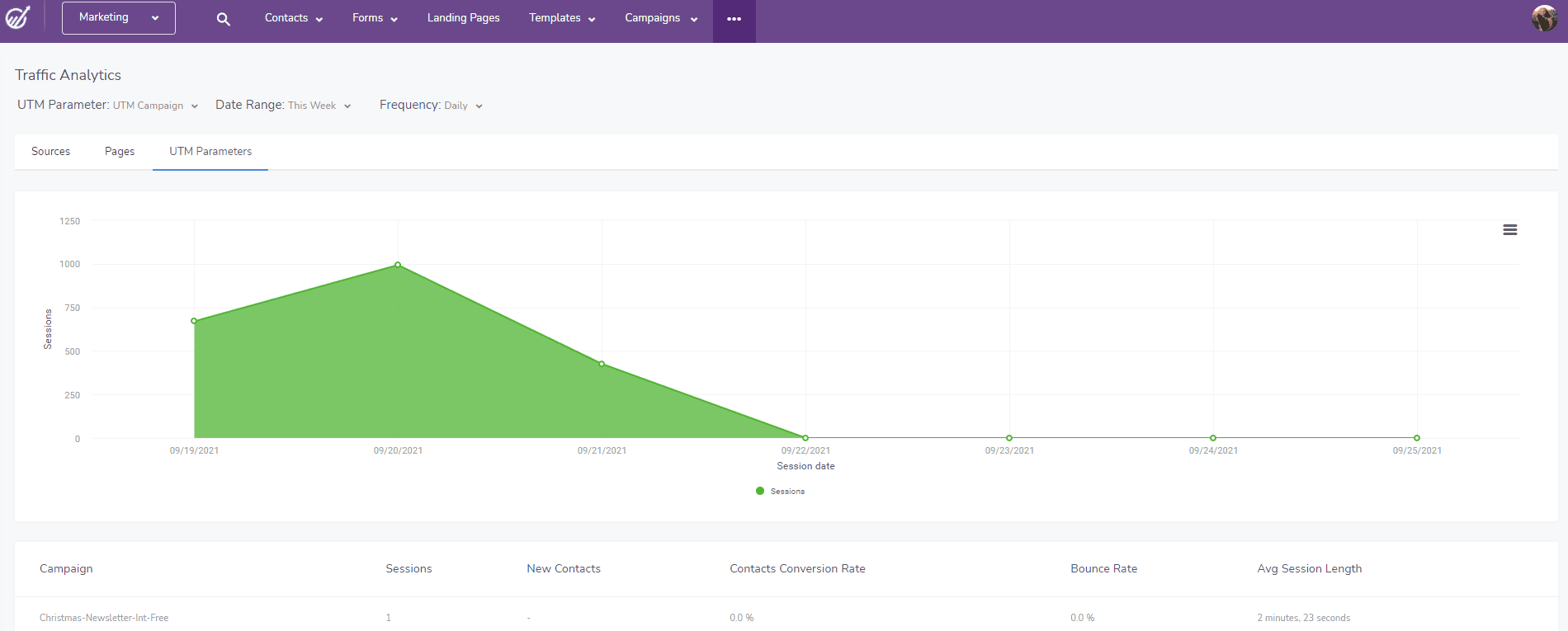

10. Reporting and Analytics

Last but not the least, one important mortgage CRM functionality is analytics.

The Analytics functionality can give you deep insights on team performance, customer engagement and satisfaction, and mortgage pipeline management.

You can get detailed reporting on existing clients, average collection periods, and much more. This way, you can make the right corrections to increase your revenue and improve your bottom line.

Final Thoughts

Mortgage CRMs keep track of important customer information, such as contact information, budget specifics, and the customer’s journey with your firm.

A unified, powerful CRM can also track customer behavior on your website, blog, and social media pages. The real estate mortgage business is a tough one, and mortgage companies that succeed are generally in it for the long haul.

This means that your mortgage CRM system needs to be versatile enough to handle all of the challenges you face at work on a daily basis.

That’s why we recommend EngageBay: a unified, powerful CRM software that can be your one-stop solution for all the mortgage CRM functionalities you’ll need.

It was designed to improve sales and customer engagement, without the sales teams having to use a dozen different apps for automated marketing.

Even the New York Times bestselling author and top digital marketing influencer Neil Patel recommends EngageBay, so why not sign up for a look at the features today?