Customer data governance is an integral component of data-driven businesses. Organizations gather customer data through several sources, and while this can produce a healthy database, it can also lead to confusion and losses if the data is not managed properly. Companies that work with disorganized datasets may find it hard to understand customer behavior.

A holistic governance approach provides businesses with the ideal framework for transforming their customer data into insightful user profiles to help teams optimize their processes. This comprehensive article provides an in-depth understanding of customer data governance and proven strategies for successful implementation.

Here’s what you will learn:

- What is customer data governance?

- How data governance has evolved

- Importance of customer data governance

- Customer data governance implementation strategies

- Overcoming customer data governance challenges

Table of Contents

What Is Customer Data Governance?

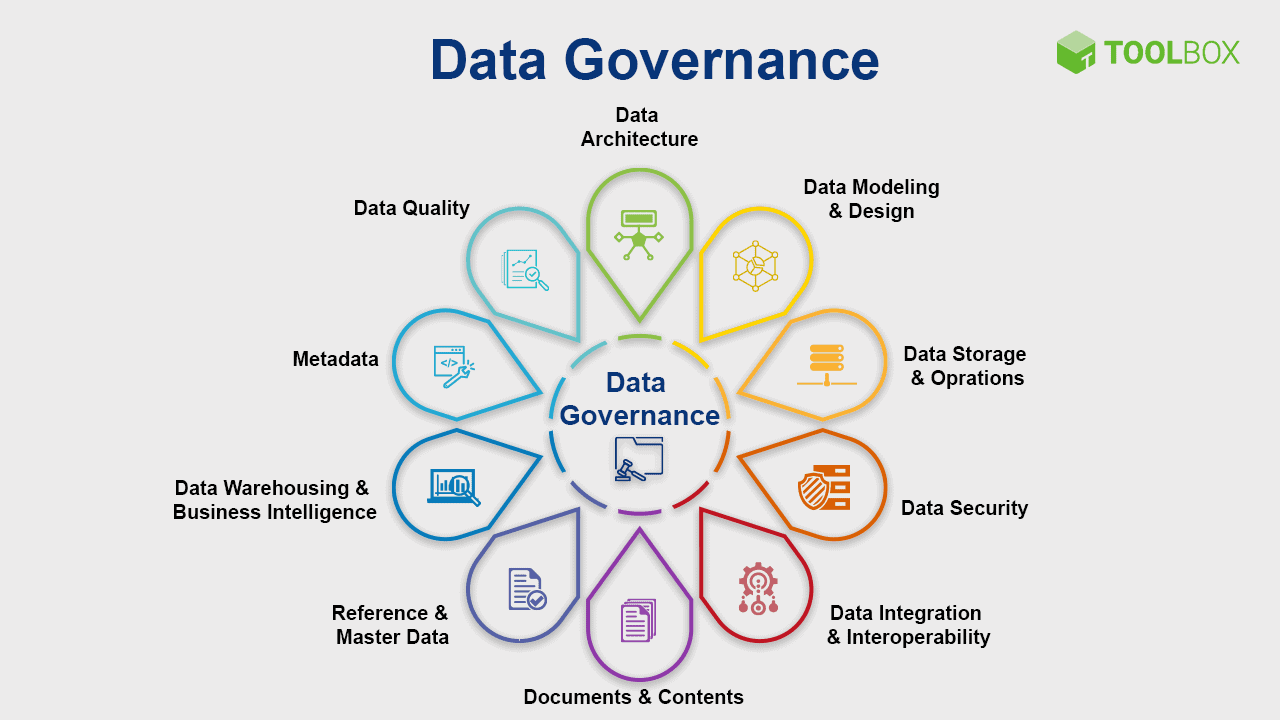

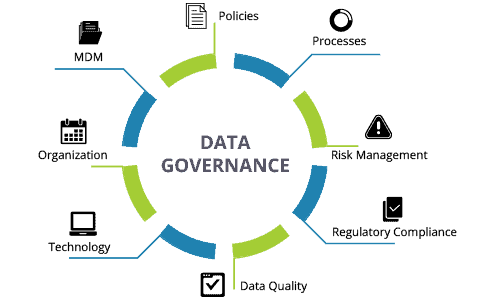

Customer data governance refers to the internal policies, processes, roles, systems, and standards determining how businesses manage customer data. It provides strict guidelines for gathering, storing, accessing, protecting, and distributing customer data across several channels.

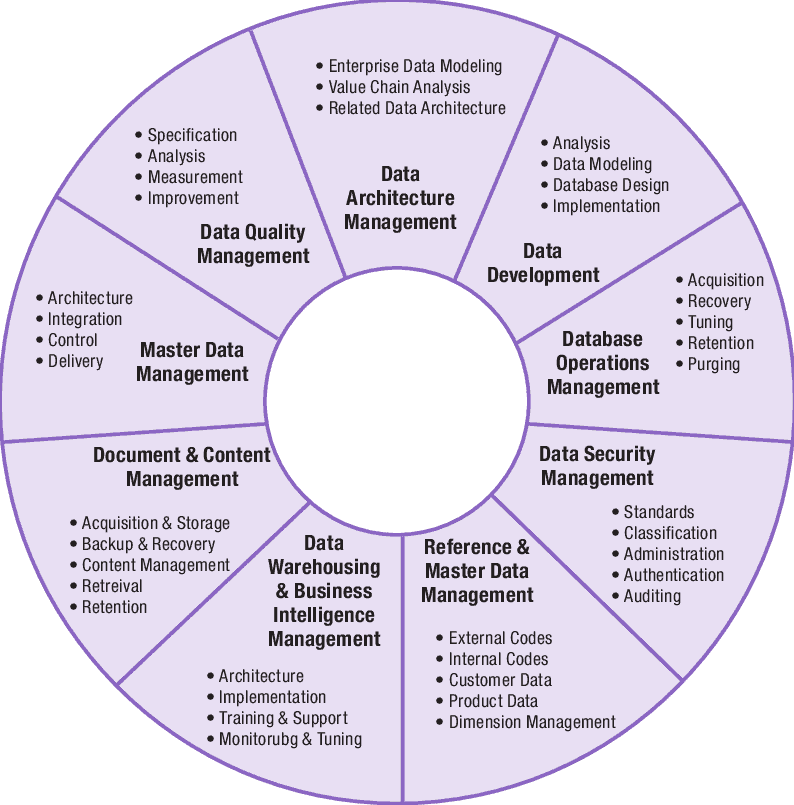

Data governance is a significant subset of data management, equipping business owners with the right systems for establishing accountability and authority around datasets. The standards support technologies, people, and principled approaches that ensure customer data is secure, available, and accurate.

Moreover, it also delivers guidelines for collecting, using, and storing customer data ethically, thus allowing businesses to comply with the data protection regulations and standards set by stakeholders and government agencies.

Large and small organizations use several techniques for collecting and processing customer data through several sources. Usually, these techniques differ as businesses adopt unique and matching processes that enable them to handle data responsibly. However, they generally help companies avoid data breaches and reputational damages – this is what customer data governance aims to achieve.

How has data governance evolved?

From the onset, data governance was considered a function of the IT department. It began with manual processes using spreadsheets and cataloging transactional data.

This was, however, a siloed approach since data wasn’t consistent across teams, and businesses couldn’t understand how customers change preferences over time. Moreover, this process was not scalable, as companies had limited resources for handling large quantities of data.

Later, modern tools were launched to streamline customer data collection, storage, and processing. Companies began to make data-driven decisions with proper analysis and real-time reports. These insights gave them a comprehensive customer view to understand how users behave.

Data governance processes also evolved to incorporate policies and standards that help businesses comply with regulatory requirements, collaborate with team members, and manage data access.

The future of data governance aims to incorporate artificial intelligence and machine learning capabilities to enhance big data processing. It encompasses the advanced processes and techniques enterprise organizations use to handle vast, unstructured data and use predictive analytics to understand customer behavior.

Importance of Customer Data Governance

Customer data governance is a foundational part of data-driven businesses, especially organizations that work with big data. So, to ensure optimized and fail-proof strategies, businesses need access governance software to check how customer data is controlled within the organization.

Customer data governance provides this framework. It influences data management practices to provide detailed and valuable customer profiles that can help business teams improve their operations. Here are some benefits of customer data governance.

1. Improved data quality

Data governance enables companies to provide strict guidelines for collecting and processing customer data to ensure accuracy, reliability, and consistency across channels. The policies create a culture of accountability to ensure data integrity.

As organizations implement policies and standards for handling data, they detect necessary and unnecessary data. This will help team members know what to collect and how to use it to improve business processes, thus minimizing errors and misinterpretations.

2. Regulatory compliance

A robust data governance framework ensures businesses adhere to data protection regulations like the GDPR or CCPA. These laws deliver specific requirements businesses should follow to protect customer data from abuse and misuse.

Data governance provides the standards for managing and handling customer data ethically and in compliance with the regulations. This safeguards customer information, thus improving trust and reducing the risk of being penalized for security breaches.

Furthermore, integrating adherence to OIG checks strengthens data governance practices, guaranteeing comprehensive regulatory compliance and enhancing overall security measures.

3. Better decision-making and risk management

Businesses that rely on accurate, reliable, and up-to-date customer data can make informed decisions by carrying out strategic analytical operations to provide real-time insights. Proper analytics provides data leaders and stakeholders with a solid foundation for business intelligence, especially when they rely on reports and insights for strategic planning and decision-making.

Data governance is critical to ensure organizations make proper decisions and manage risks effectively. The principles guide businesses on how to use data effectively to protect their reputation and avoid non-compliance penalties.

4. Enhanced data security

A solid customer data governance framework defines specific policies and standards businesses must keep to ensure the safety of customer data. It outlines the required procedures and steps that guide certain circumstances around how data is used in the organization. This includes data collection, processing, usage, storage, distribution, access, etc.

These policies also place data in different categories based on their level of sensitivity and confidentiality. It also defines personnel and managers authorized to access, modify, or update the data. The robust system plays a pivotal role in ensuring privacy, mitigating security breaches, and safeguarding user information.

5. Increased operational efficiency

Businesses that rely heavily on data will require a functioning framework that delivers positive results while reducing costs. Companies can improve operational efficiency by eliminating redundancies and unnecessary data duplication.

With customer data governance, organizations can formulate procedures for gathering correct data, cleaning the customer database, and using available data for the right purpose. This prevents businesses from spending resources on strategies that are not needed.

6. Improved team collaboration

Customer data governance involves roles and responsibilities that enable business owners and team members to improve operational efficiency. By setting clear guidelines and procedures, several departments can collaborate effectively. They can also share data and define the roles each team member has to play.

Customer data governance creates a sense of accountability among team members since they collect data in several formats and process it to deliver a common language. This eliminates data silos, as different departments can use a comprehensive database to create refined processes and workflows.

Read also: A Guide To Enhancing Customer Data Management

7 Customer Data Governance Implementation Strategies

Customer data governance involves extensive processes influencing how businesses manage their customer information. But with a well-planned strategy, there can be successful implementation and execution of your policies and systems.

We have listed seven essential strategies to help you execute your governance practices and transform your customer data into valuable assets.

- Identify your customer data governance goals

- Assign roles and responsibilities

- Build a business glossary and data dictionary

- Create a data governance framework

- Adopt tools and technologies

- Monitor and measure your progress

- Update and refine the process

1. Identify your customer data governance goals

Your implementation strategies will depend on clear, refined data governance goals – short-term or long-term. This plan includes processes, guidelines, and techniques aligning with your overall business objectives. Some of these may include.

- Improving internal and external communications

- Reducing costs and improving operational efficiency

- Promoting data-driven decision-making

- Improving data quality and security

- Setting clear rules, standards, and roles

Generally, your business model and structure will determine your goals, so it’s crucial to consider the external and internal factors that can influence your decisions. Identifying what you aim to achieve with your data governance strategy gives you an edge while establishing transparent processes that keep you focused.

Moreover, a well-structured data governance plan guides your prioritization and keeps your teams accountable.

2. Assign roles and responsibilities

Once you’ve set the blueprint, you can assign clear roles to stakeholders, decision-makers, managers, and everyone who will be involved in the execution of the plan. These responsibilities define who handles data collection, storage, modification, distribution, etc.

Since all members work with the general business goal, they have a common understanding of the data and how they can tailor it to their unique processes to steer the data governance initiative. Some of these roles may include data governance officers, specialists, data custodians, IT subject matter experts, data stewards, etc.

The functions of these roles vary depending on the business and data governance structure. However, with strict data governance policies and a clear understanding of the responsibilities, businesses can assign roles to individuals with the right skills and knowledge. It provides a system for training and onboarding new members while developing a framework that helps them align with your business goals.

3. Build a business glossary and data dictionary

Though different, business glossaries and data dictionaries serve similar purposes as they add context and meaning to business data.

Usually, departments collect different data types in varying formats. Still, there can often be conflicts and misinterpretations of various datasets since a particular term may mean different things to different teams. For example, the meaning of the terms “delivery,” “user,” or “customer” can differ across customer support, sales, marketing, warehouse, IT, or legal teams.

These inconsistencies can be avoided with a centralized repository of data definitions and business rules. A robust data dictionary or business glossary gives you a better understanding of your customer data while serving as a reference point to help users match correlating datasets.

4. Create a data governance framework

A solid framework is the decisive factor in the success of your customer data governance implementation strategy. Your framework defines the rules, policies, protocols, standards, guidelines, systems, people, and every other facet that can influence the overall data management process.

A robust data governance framework includes a comprehensive document that decides how data assets are managed and how policies will be enforced across various departments. This framework also provides a structure that outlines how roles and functions will be assigned to individuals to improve team efficiency and productivity.

In compliance with the necessary data regulations, proper documentation should be created to guide stakeholders in managing and handling customer data. Establishing this framework ensures all team members and managers adopt clear protocols and stay focused while handling their tasks.

5. Adopt tools and technologies

A data governance strategy is incomplete without the right tools and systems to streamline your processes. From data collection to processing, storage, distribution, etc., your business will require simple and complex procedures to handle your operations.

Investing in the right tools and technologies exposes you to tailored functionalities for workflow automation, data monitoring and tracking, enhanced data security, smart segmentation, etc.

There is a vast array of systems and platforms designed to help you manage your customer data. However, they have varying capabilities, so choosing the right tool tailored to your business model and structure is essential.

6. Monitor and measure your progress

While creating data governance goals is important, developing a system for monitoring your progress over time is also crucial. This will help you determine the success of your strategy. A comprehensive analytical process defines the major metrics and KPIs you should track once you have executed your strategy.

A thorough evaluation of this strategy helps you track and measure your data governance effectiveness. Also, regular monitoring allows you to identify loopholes in your processes and areas for improvement. Many times, proper implementation of a well-planned strategy will yield positive results. Still, when things fall, conducting a critical review is essential to determine what needs to be added or removed.

7. Update and refine the process

As you review your strategy and evaluate your performance over time, you can develop refined processes that improve your effectiveness. Evolving and updating your data governance program enables you to stay in touch with the current trends in your industry while maintaining success.

These changes may include upgrading onboarding and training, policy changes, restructuring standards, eliminating redundant procedures, or adopting new systems. Usually, businesses rely on past data to help them gather enough feedback to identify and prioritize changes.

Read also: Master Customer Data: A Guide For Customer Insights

Overcoming Customer Data Governance Challenges

Generally, most businesses will face some challenges while implementing their data governance strategies. No matter how sophisticated a framework is, organizations may encounter a few drawbacks that can limit their progress.

Here are some common challenges associated with customer data governance and how to overcome them.

1. Scalability

Small businesses that don’t plan to grow fast don’t have problems with scalability since they usually work with a small database and have well-structured systems for handling an estimated data volume. However, this is not the case with fast-growing enterprises, as their systems may become outdated too soon or cannot handle the increasing demand.

As businesses grow, they restructure their processes to accommodate new changes. Most times, this process can be challenging because they’d have to adopt systems that may incur more costs, require policy changes, or demand more workforce.

Businesses can overcome this challenge by setting realistic goals and developing a well-planned strategy that gives them insights into what to expect and how to accommodate the necessary changes. This way, they can optimize governance practices to scale with business growth.

2. Data accessibility and security

Customer data plays a pivotal role in driving business decisions, so organizations usually create systems to secure their user information and enable access to only authorized individuals. Many businesses face the challenge of safeguarding their data from cyber threats and security breaches.

Even more, choosing authorized managers can be daunting since you will require personnel with specific skill sets. Regardless of your data type and source, it is essential to create secure systems and policies that guide the management of your customer data. These systems also include how to optimize your operations even in the event of a data breach.

By assigning specific roles to individuals, you can decide who handles each process in your data governance strategy.

3. Business budget and resources

Businesses with big goals, ambitions, and strategies may fall short of their expectation if they lack the necessary resources for implementation. A huge chunk of the business budget will cover developing and maintaining a solid data governance framework.

Businesses with limited resources may not have the flexibility to create extensive frameworks or adapt to new technologies and market changes. If your organization is on a low budget, you may have to tailor your strategies and prioritize processes to fit your pocket. This way, you can adopt sustainable systems that match your business model and style.

4. Data governance integration

Data governance is a different facet of your overall business operations, and since it involves certain processes that work independently, integrating it with your business operations can be challenging. A seamless sync can enhance your workflow and improve your team’s efficiency. However, this process is time-consuming, complex, and requires technical knowledge.

Understanding the scope of your business operations and the requirements for developing an integrated data governance system is key to aligning your framework with existing business strategies. Also, you can adopt suitable automation tools to streamline manual processes and improve our efficiency.

5. Data quality

Since different businesses require different types of customer data, defining what “quality” represents for your business can be challenging. Also, some organizations may lack a structured policy for ensuring data quality and a clean database. In this case, team members may not know what data to collect and how to use it to improve their processes.

Businesses can overcome this challenge by creating standards, policies, and guidelines for ensuring data accuracy, completeness, and consistency across different boards. They can also develop a unique process for handling data quality issues when they occur. So, regardless of the data source and type, team members can follow strict rules to gather the right data an organization needs to make key business decisions.

Read also: Top 9 Customer Data Platforms with Pros and Cons

Final Takeaway

A well-structured customer data governance approach can guarantee sustained success as it pieces together several systems, people, and technologies that can develop unique frameworks for optimizing business operations. Although the process is complex and extensive, there are specific techniques tailored to your organization that can help improve operational efficiency and yield greater returns on investment.

Usually, businesses may face certain challenges that hinder their progress. However, a solid data governance structure and framework can create a fail-proof system that handles issues that may arise. With the practices shared in this article, you can develop your unique governance best practice to manage your customer data.