Without capital goods, there would be no businesses to run. But what are capital goods? Why are they so important for our economy?

Capital goods are commodities used to produce other goods and services that are offered to consumers.

They involve factories, tools, and machinery used during the production process or to provide services. They are usually known as a company’s fixed or long-term assets since they provide value for more than a year.

Table of Contents

Capital Goods Defined

Capital goods are the tangible assets businesses use to produce final products. A tangible asset is a physical asset, such as machinery, vehicles, manufacturing plants, buildings, etc, owned by the company. In fact, capital goods are commonly labeled as ‘property, plant, and equipment’ in a company’s financial statements.

Capital goods production involves creating tangible assets that experience depreciation and wear and tear after a certain period. The depreciation expense for capital goods is recorded in a company’s accounting books every financial period, and the asset is disposed of or discarded once its value reaches zero.

Capital goods are not finished goods. Instead, they are considered a subset of durable goods used in manufacturing finished products. It is also considered one of the four primary factors of production, including land, labor, and entrepreneurship.

Some popular capital goods companies in the USA are 3M, Caterpillar Inc., and General Electric.

Read also: A Guide to SPIN Selling: Definition, Tips, and Best Practices

Capital Goods vs Consumer Goods

Capital goods are tangible assets used by enterprises for the production of finished goods and services. Whereas consumer goods are products that are purchased for final consumption and not for manufacturing other goods or services.

This is why consumer goods are also known as final goods since they drive consumer spending. Capital goods, on the other hand, are used to process raw material and intermediate goods to deliver the final good. Capital goods are sold to other businesses for production purposes.

Some examples of consumer goods are food, clothing, and electronics. And in the case of capital goods, common examples include capital assets like machinery, property, plant, equipment, tools, buildings, and vehicles.

Besides manufacturing, businesses acquire capital goods to improve their efficiency and production capacity. Hence, they are expensive and require a large capital expenditure.

The capital goods industry plays a vital role in the economy because it supplies the necessary machinery and equipment that drive technological advancement in various sectors.

Consumption goods can be divided into three categories — durable goods, non-durable goods, and services.

Durable goods last longer than a year and include electrical appliances, motor vehicles, and furniture.

Non-durable goods have a lifespan of less than a year and are also known as perishable products. Examples of non-durable goods include food, clothing, and gasoline.

Services are intangible assets such as haircuts, banking, legal services, etc.

So, can a product be a capital good and a consumer good at the same time? Depending on the end user, a product can be classified either as a capital or a consumer good.

For instance, if a car has been purchased for personal use, it will be considered a consumer good. On the other hand, if a business has acquired a car to transport finished products, it will be classified as a capital good.

Read also: You Understand What Strategic Selling Means? It Is Not What You Think

Importance of Capital Goods

There are various reasons why capital goods are important for a country’s economy. Let us look at some of them.

1. Improves productivity

Producing goods manually is a complex and time-consuming process. It also results in less production and higher costs overall.

Businesses can increase productivity by acquiring core capital goods such as machinery and equipment. More goods can be manufactured in less time and at lower costs.

As a result, companies can boost employee productivity and revenue.

Read also: IKEA Marketing Strategy: A-Z Analysis of the Winning Formula

2. More rewarding

Businesses can enjoy a high return on investment in the capital goods sector.

By purchasing suitable machinery, you can produce a large number of high-quality goods in a very short span of time, which can boost your sales and profits.

With positive financial performance, more investors will be keen to invest in your business, giving you more access to capital and resources.

Read also: Return on Sales: Does Your ROS Make Sense Yet?

3. Acts as a reliable economic indicator

Capital goods are considered an excellent indicator of the economy. When companies spend more on acquiring capital goods such as equipment and machinery, it is a sign that they will increase production.

Production of goods and services will only increase when economic conditions are favorable or due to an increase in sales. The government encourages this through the capital goods scheme.

Hence, expenditure on capital goods is one of the indicators to understand the direction of economic growth in the future.

Read also: The Extraordinary Power of Customer Needs & How to Solve Them

Examples of Capital Goods

Below is a list of a few examples of capital goods.

1. Machinery

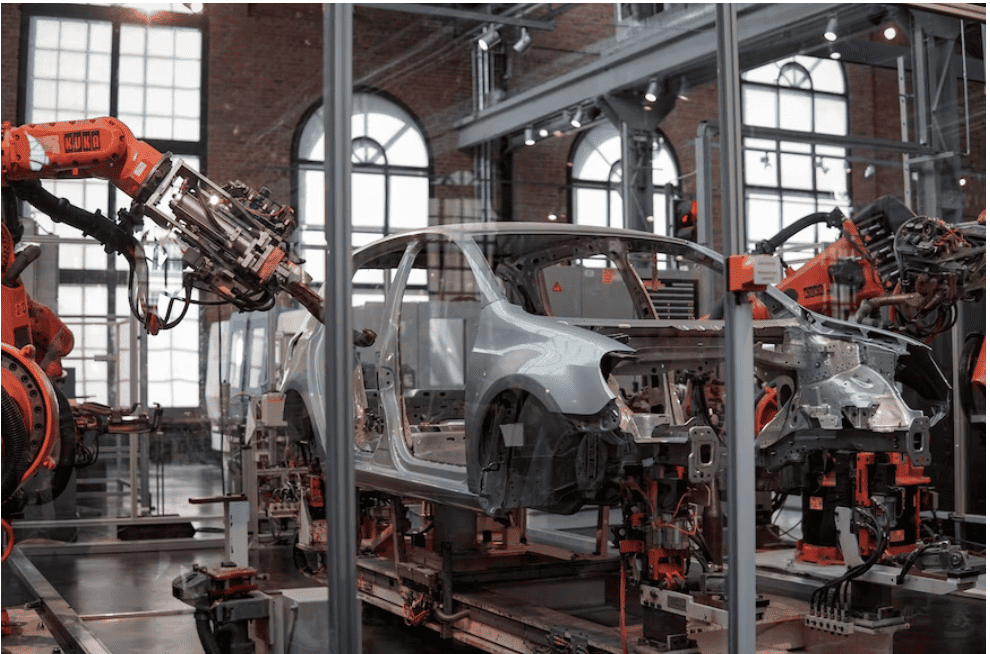

Machinery is used in the production of other goods and services. Some examples of machinery involved in manufacturing include industrial robots, grinders, drilling machines, shearing machines, saw machines, and so on.

2. Vehicles

Vehicles owned by businesses are considered capital goods. They are used to transport products from one place to another. Typically, vehicles used as capital goods include trucks, vans, and cars.

Read also: Where to Sell Handmade Items Online Globally

3. Software

While software is considered an intangible asset, it can be considered capital goods when it supports production processes and operations. Examples include CRM, accounting, human resources, communication tools, web browsers, office suites, etc.

4. Facilities

Facilities include spaces used for the production of goods and services. A fixed asset like a factory, an office building, or a data center can be considered a facility.

5. Furniture and Fixtures

Furniture and fixtures comprise tools such as desks, tables, chairs, and other office equipment. While they may not be directly involved in manufacturing, since they are used by production units, furniture and fixtures are categorized as capital goods.

Read also: Wealth Management Marketing Strategies for a Brighter 2024

Wrap Up

Capital goods, also known as fixed assets, long-term assets, or tangible assets, are used for the production of other goods and services. Capital goods are beneficial since they help increase productivity and efficiency, which, in turn, boosts revenue and profits for businesses.

Content updated for freshness and SEO by Swastik Sahu.