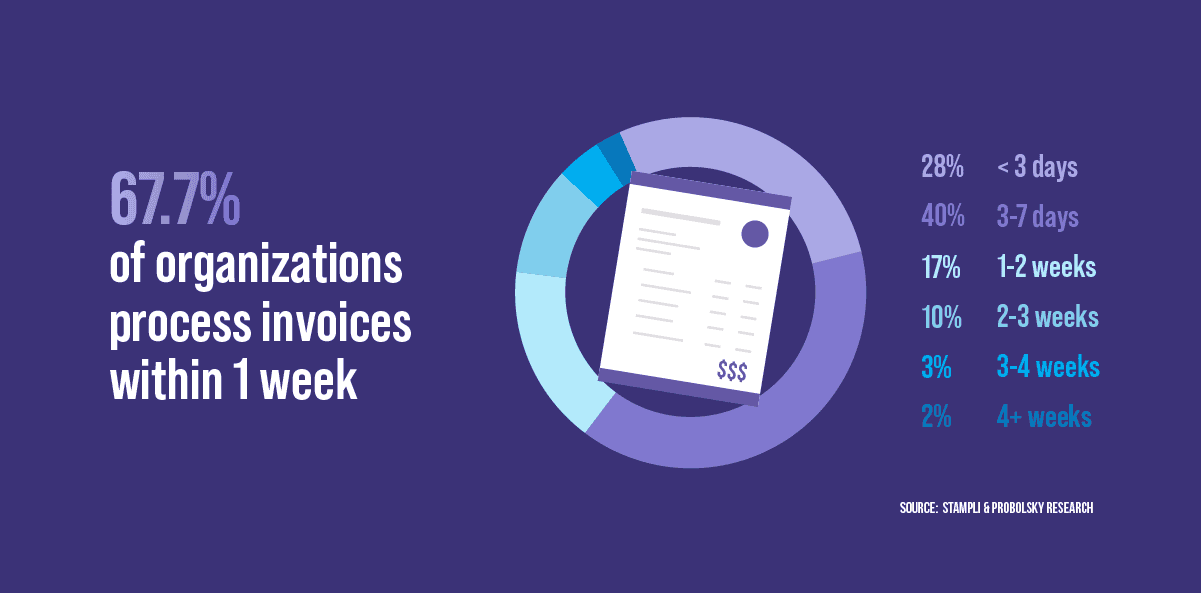

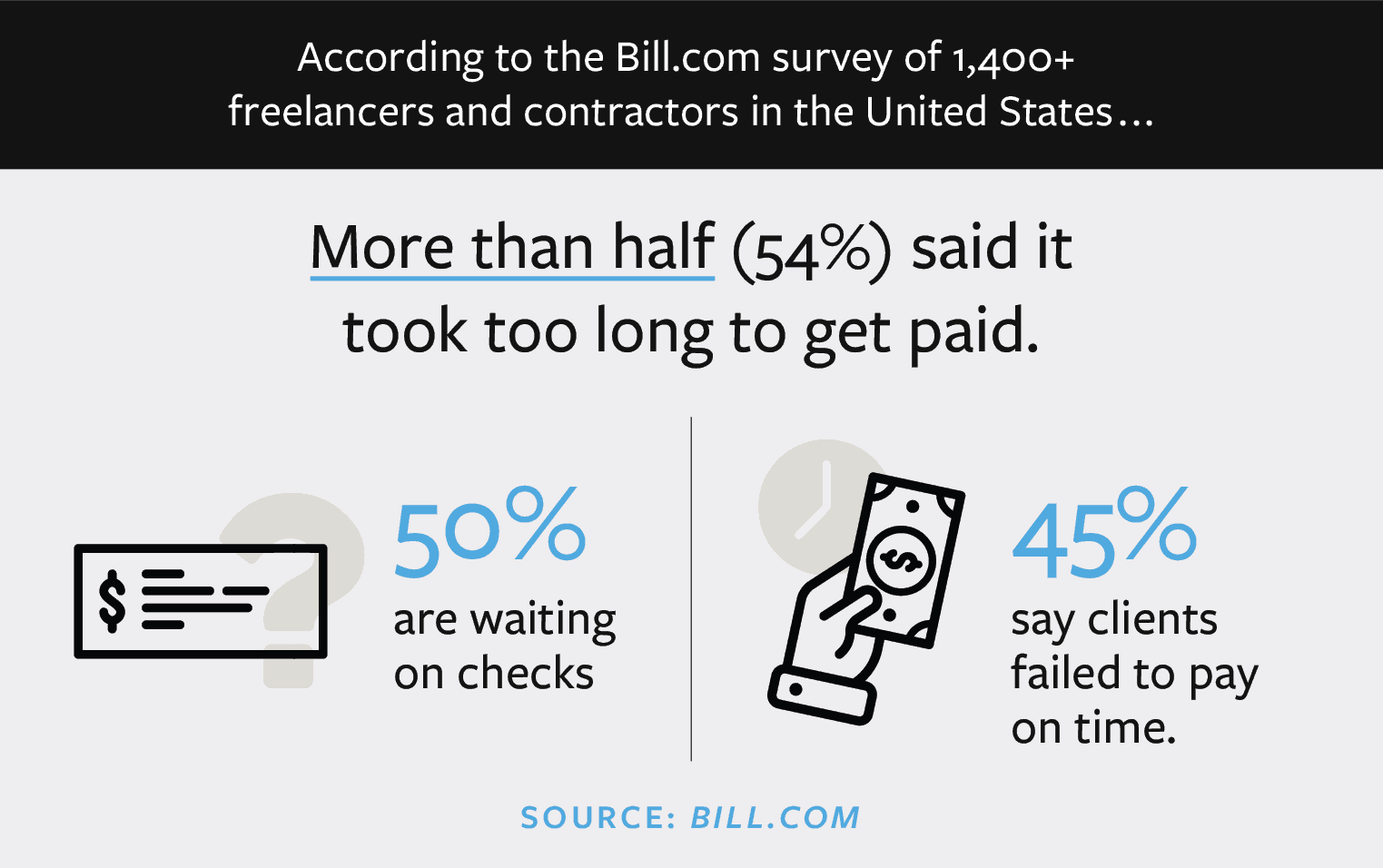

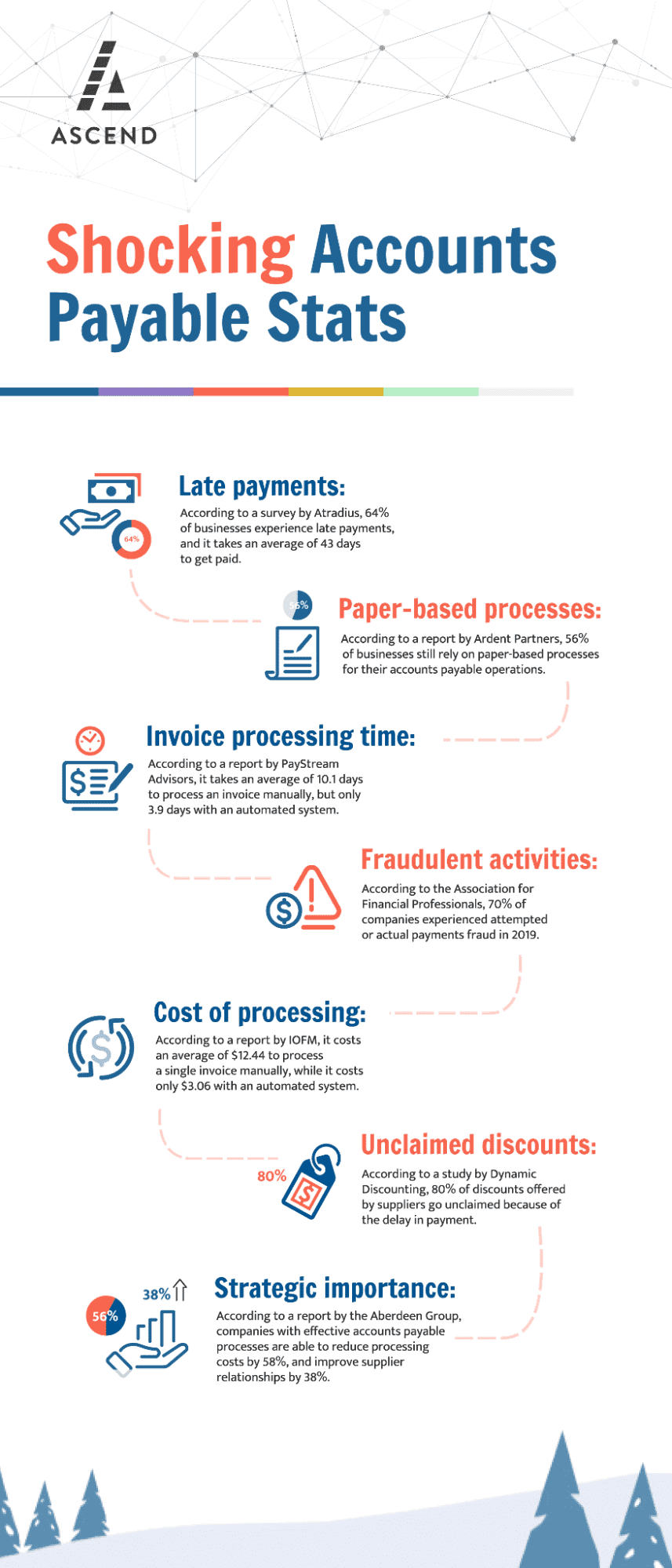

Whether you are a small business or a giant organization, timely payments are critical in ensuring good revenue. Most small businesses, freelancers, and self-employed workers usually deal with a few customers who appreciate the work but don’t pay on time.

It is an inevitable but harsh truth to swallow.

The situation gets tense if the due amount is the critical source of revenue. Some businesses opt for a soft payment reminder email, whereas some can’t bear the delay, and they speak harshly.

Delayed payments indeed cause issues; however, a friendly reminder mail can help you get the payment without losing the client.

Writing an appropriate invoice reminder mail that outlines the payment term is the best option for encouraging invoice payment. However, determining what to include (and what not to) can be challenging.

Instead of guesswork, you can choose from these seven proven payment reminder email template examples that work 🙂

Table of Contents

1. Payment Reminder Email Template: Two Weeks Before the Due Date

To help streamline the payment process and make it easier for clients to settle their invoices, it’s best to send the payment reminder two weeks before the due date. This way, they have an idea of the amount to be paid.

Also, it’s essential to include the current invoice as an attachment in every payment reminder email. Incorporating invoice attachments minimizes the effort clients need to expend searching for their invoices, thus encouraging faster payments.

In each template you use, standardize the practice of mentioning that the invoice is attached. You can place this at the end of the email to ensure the client knows where to find it.

Subject Line: Friendly Reminder: Upcoming Payment for Invoice #10101

Hi Dave Lee,

I hope you’re doing well! I just wanted to gently remind you about the upcoming payment for Invoice #10101, which we sent on Saturday, September 16. The payment is due in two weeks, and I wanted to ensure it stays on your radar.

For your convenience, the invoice is attached. Please review it and let us know if you have any questions. We’re always happy to assist!

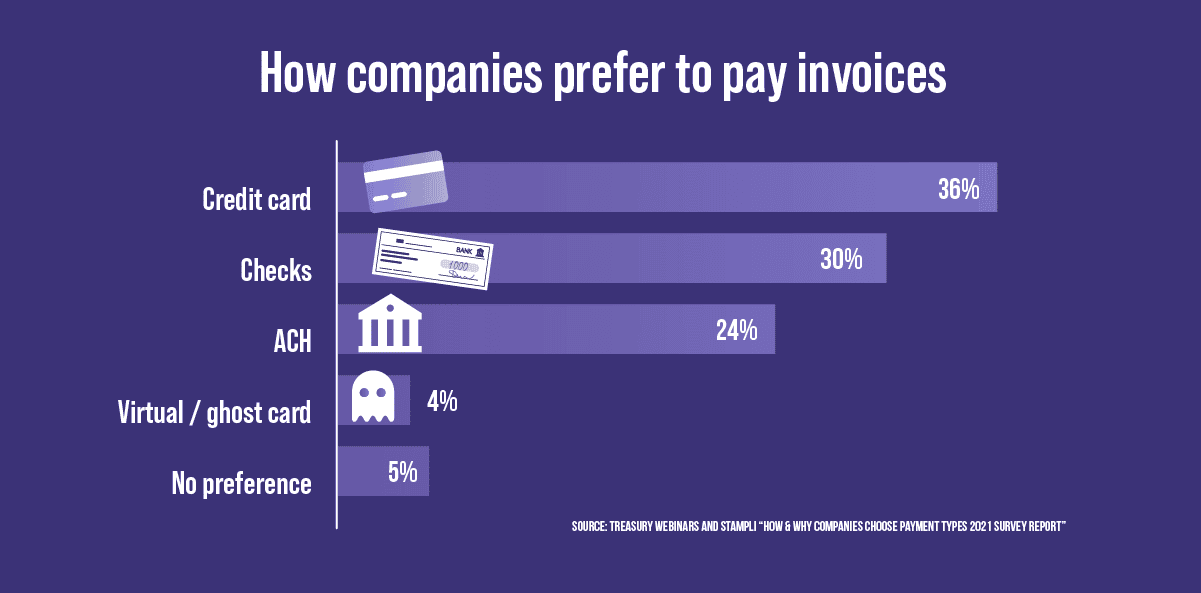

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Thank you in advance for your attention.

Warm regards,

[John William]

Best practices for attaching invoices to email

When including sensitive information like invoices, following security guidelines to protect your business and the client’s data is essential.

- Use PDF format: PDFs are ideal for invoices because they maintain their formatting and are less prone to unauthorized modifications. Most accounting or billing software can export invoices in PDF form.

- Use descriptive, organized file names: File names should be clear and follow a consistent format. This helps clients easily locate the correct invoice, particularly if they have multiple invoices with your company.

- Verify Attachment Before Sending: Always double-check that you’ve attached the correct invoice before sending the reminder. This simple step can prevent confusion and delay in payments.

Attach the invoice at the end of the email, and remember to mention the attachment right before you sign off. This ensures the message flows naturally and the client’s attention is drawn to the fact that the invoice is available.

2. Payment Reminder Email Template: One Week Before the Due Date

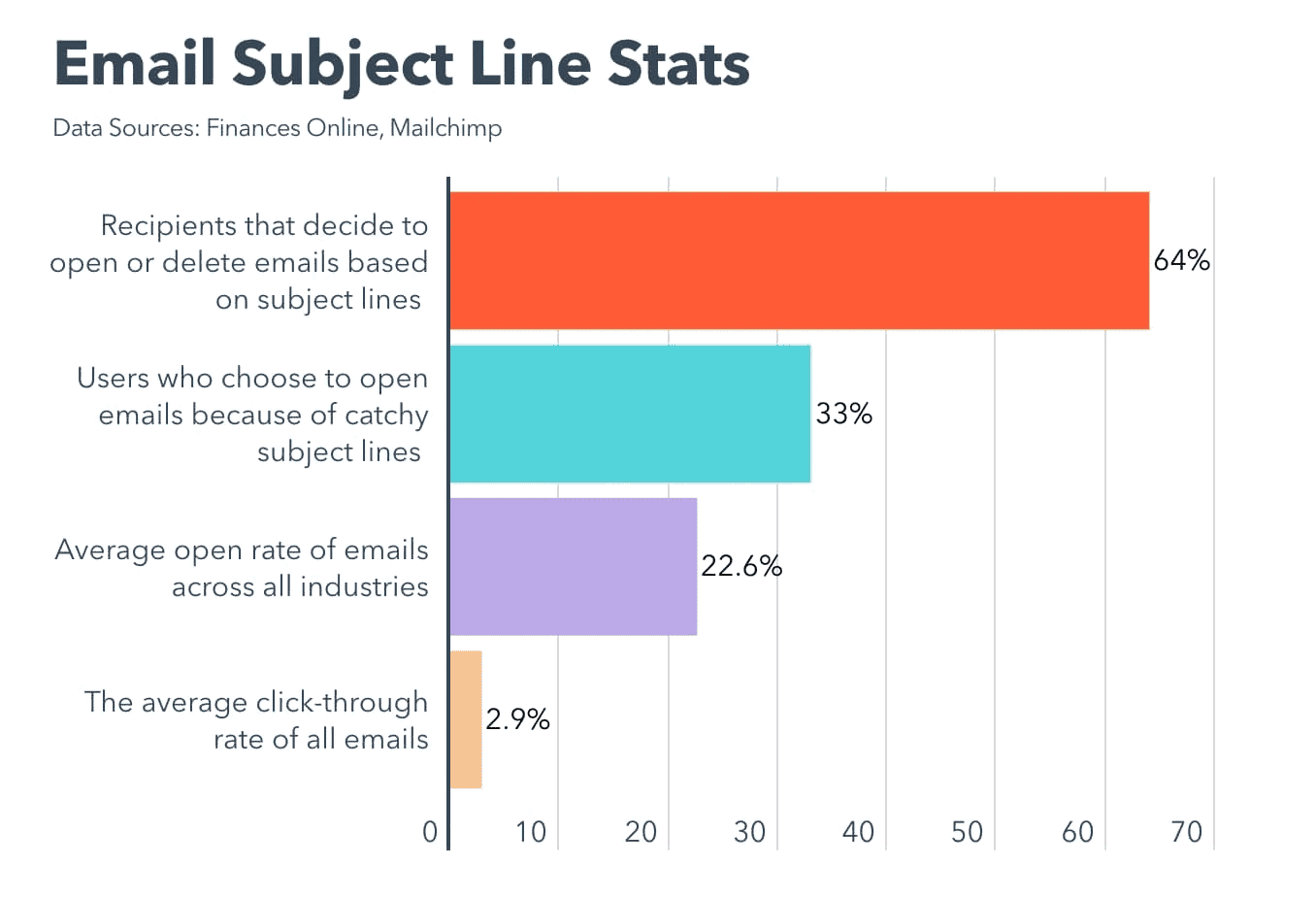

Whether you are writing an initial payment reminder mail or after the due date, an appropriate subject line in a mail plays the most crucial role in getting noticed. So, start by writing a simple and catchy subject line like:

- Initial Payment Reminder Invoice No. #10101

- Follow-up of Invoice No. #10101

After writing a perfect subject line, you are halfway through the process. Finally, it is time to greet and discuss the payment due date.

Subject line: Follow-up of Invoice No. #10101

Hi Dave Lee,

I hope you are doing well! This is a quick payment reminder mail.

We sent Invoice #10101 on Saturday, September 16. The payment on the Invoice will be due next week.

I’m pretty confident you are mostly busy with work, but I’d be grateful if you could spare the time to look over the Invoice attached below.

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Please let us know if you have any queries.

Thank You!

Warm Regards

[John William]

Enhance Your Email Marketing

Want to make your sales emails more impactful? Check out our beautiful, easy-to-customize payment reminder email templates. Designed to boost engagement, these templates from EngageBay will help your emails stand out. Just customize the images, headings, and CTAs for your brand, and hit send in a few minutes!

3. Payment Reminder Email Template: One Day Before the Due Date

Subject Line: Quick Reminder: Invoice #10101 Due Tomorrow

Hi Dave Lee,

I hope everything is going great on your end! A quick and friendly reminder that payment for Invoice #10101 is due tomorrow, and I am bringing it to your attention in case it slipped through the cracks.

For your convenience, the invoice is attached. Please review it and let us know if you have any questions. We’re always happy to assist!

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Thanks so much for your time.

Warm regards,

[John William]

Read also: Feedback Email Templates to Increase Engagement in 2024

4. Payment Reminder Email Template: On the Due Date

When dealing with an overdue payment, sending a late payment reminder can be effective.

They might have even responded to the first email you sent them, letting you know that they know the amount they owe you and intend to pay it as soon as possible. They must pay their balance now that that week has ended.

When you’re sending a reminder mail to your customers on the due date itself, it is not necessary to ask them how they felt about the product or service they received from you. Instead, it should emphasize how much money they still owe.

But that doesn’t mean you can’t use a soft tone. Your client most likely currently faces a difficult financial condition. Therefore, going above and beyond to demonstrate empathy could greatly aid your efforts to collect, particularly when payment is due.

Subject line: Reminder: Invoice #10101 Due Today

Hi Dave Lee,

This is a quick payment reminder message to let you know that invoice #10101 is due today.

If you have any difficulty making the payment, you can just reply to this email or call us at [Phone Number]. We’ll work together to get your payment settled.

For your convenience, the invoice is attached. Please review it and let us know if you have any questions. We’re always happy to assist!

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Please let us know if you have any queries.

Thank You!

Warm Regards

[Your Name]

Read also: Notification Email Templates to Get More Responses (2024)

5. Payment Reminder Email Template: Shortly After the Due Date

Customers want you to think well of them. It’s still possible that they acknowledged receiving both of your emails requesting payment but haven’t paid the amount yet. It does happen, despite how crazy it may seem.

Or possibly they didn’t respond to your subsequent communications. You must keep putting in the effort to obtain what you owe in any scenario.

How frequently you send payment reminders has probably already been clear to you. We started sending one email per week seven days before the deadline. This example employs a similar strategy.

Subject line: Reminder: Invoice #10101 Past Due – Please Take Action

Hi {Client Name},

According to my review of our records, you have an outstanding invoice numbered #10101.

I’m writing this email because it’s been a week past the due date.

But don’t worry; you haven’t yet racked up any late fees because of this.

I’ve taken the courtesy of attaching your invoice to this email in case you couldn’t find it.

You can pay the due amount using your preferred payment method by visiting this link [Link to Invoice].

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Thank You,

[Name]

Read also: Reminder Email Templates to Keep Your Audience On Track

Include late fees and enforce them

Small fines, such as a late fee with 2% interest every calendar month, may encourage clients to pay their bills on time. Be sure to communicate your late fee policy to customers using polite but firm language in your Terms and Conditions agreement.

Customers may be assessed interest on the whole amount of their invoices if they do not pay them on time. If you decide to do this, the computation will be dependent on how many days the invoice is past due.

6. Payment Reminder Email Template: Two Weeks After the Due Date

Another email reminder is required if the consumer still hasn’t paid the invoice two weeks after the due date. Even though the situation is not urgent, you can now talk with more confidence. Tell your client that you will be sending them reminders to ensure timely payment.

Don’t forget to include the payment processing details, including the total and the methods that can be used. To include those, simply make sure the invoice is attached to your message.

Additionally, it is a good idea to ask for proof of email receipt to ensure that your payment reminder emails are being viewed on the other end.

Subject line: Payment Reminder: Invoice #10101 Overdue by Two Weeks

Hi [Client Name],

We’re contacting you again about the late payment for invoice #10101, which is now two weeks overdue.

The payment is [Amount], and you can pay your outstanding amount by visiting this link [Link to Invoice]. The invoice and the contract are attached below.

If payment is not received by [Due Date], a late fee of [X]% will be applied as agreed in the contract.

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

If you have any questions or problems regarding the payment, please contact us. Also, please acknowledge that you have received this message.

Thank You,

[Your Name]

Read also: 10 Customer Service Email Templates for New CRM Users

7. Payment Reminder Email Template: One Month After the Due Date

After your initial round of reminders, it’s advised that you temporarily stop contacting the delinquent account from which you’re trying to recover. In the realm of actual postal letters used for collection, this is also true, but with emails, it is even more so.

Email is a user-driven medium. The receivers ultimately decide what happens to your correspondence. If enough users continue to mark emails from your domain as spam, message retention will eventually decline. Even worse, you can end up on a blacklist, where no one will ever get your communications.

We are not suggesting that you quit trying to get the money that is owed to you. Instead, you only need to wait a little bit longer, more specifically, at least a month.

Subject line: Immediate Attention Required: Invoice #10101 30 Days Past Due

Hi [Client Name],

Over the past month, I’ve tried multiple times to get in touch with you regarding the outstanding payment on your invoice #10101.

I’m writing to remind you that you are 30 days past due on the balance with us.

You have the flexibility to choose from various payment options to settle your overdue invoice. Simply visit this link [Link to Invoice] to proceed with your preferred method of payment.

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

If payment isn’t made by [New Due Date], a late fee of [X]% will be charged, and services may be suspended.

I’m guessing that my earlier emails got lost in the shuffle. Please respond to this email to let me know you’ve received it.

Thank You,

[Name]

Read also: What is Sales Planning? Tips & Downloadable Templates for Beginners

8. Payment Reminder Email Template: Two Month After the Due Date

There’s a strong chance they won’t pay you by the time their account is 60 days past due, and you’ve sent your client various email reminders.

Even so, up until the 90-day point, you should keep trying to collect on past-due accounts. When the amount is already 60 days overdue, you must approach it firmly. If the client hasn’t gotten in touch with you regarding their attempt to pay their due, they are undermining your professionalism.

Subject line: 60 Days Overdue: Settle Invoice #10101 to Avoid Service Suspension

Hi [Customer Name],

I’m sending you another email to let you know that your unpaid debt from invoice #10101 is still owed. Your account has a 60-day past-due balance.

As a result, you might be charged interest in accordance with the conditions that we have mutually agreed upon.

If payment isn’t made by [New Due Date], a late fee of [X]% will be charged, and services may be suspended.

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

Please reply to this email if you have any questions about this payment. If not, kindly visit [Link to Invoice] to pay your outstanding sum straight away.

Thank You!

Warm Regards

John William

Read also: 15 Introduction Email Templates That Work Like A Charm

9. Payment Reminder Email Template: Last Effort

Your payment has been due for three months by the time you reach this point. The additional time is two months later; the client has one month before the due date to pay the entire amount owed. In other words, this is the worst-case scenario.

If the accounts are this old, consider them lost and take the following steps accordingly. This can involve contacting a debt collection business you are familiar with and giving them the keys.

But before you do, send the client one last email to remind them of the situation with your account.

Subject line: Final Warning: Invoice #10101 – Pay Within 15 Days to Avoid Collections

Hi Dave Lee,

The notice we are sending you about your past-due account is the last one. You have not replied to my 90-day late invoice #10101.

We must acquire payment from you within 15 days of receiving this notice to stop further attempts at collection by a third party.

As a result, you might be charged interest in accordance with the conditions that we have mutually agreed upon. The invoice and contract are attached below.

If payment isn’t made by [New Due Date], a late fee of [X]% will be charged, and services may be suspended.

Available Payment Options:

- Credit/Debit Card: Pay directly through our secure payment portal [Insert Payment Link].

- PayPal: Use your PayPal account for fast and secure payments. [Insert PayPal Payment Link]

- Bank Transfer: Transfer to [Bank Name], Account Number: [Account Number], IFSC Code: [IFSC Code]. Please mention your invoice number in the transaction note.

If you have any more questions, you can call us at [Phone Number] between 8 am and 5 pm.

Thank You!

Warm Regards

John William

Read also: Corporate Email Templates to Nail Your Business Communications

Tips to Write Professional Payment Reminder Templates

Responding with caution rather than anger is the best action for responding to unpaid invoices. Here are some guidelines for crafting effective payment reminders for customers.

Use a clear subject line

Include all the information they need in the subject line to make your client’s life easier.

When writing your email’s subject line:

- Use specific terms, such as “Payment Reminder:”

- The invoice number should be entered.

- Include the payment due date

👉Enhance your communication skills by learning to say ‘sorry for the inconvenience‘. Dive into our article for more.

Begin by introducing yourself politely

Even though you want to send a payment reminder, you should always start your emails with politeness. Introduce yourself appropriately and personally at the outset of your email. You can be sure that your payment reminder will be considered if you do this.

You can use the client’s name and add a small wish note.

Read also: 12 Email Invoice Templates to Customize and Click Send

Be clear about the payment terms

The most important part of your email is a gentle reminder to the client of the amount due and the deadline. Clearly state the invoice’s due date and leave out any unclear jargon. A crisp and clear email with straightforward details will likely ensure prompt payment.

Be sure to include payment details

Even though you might offer payment details on the invoice itself, you should still make it evident in the email body how to make a payment. Include all the payment details clearly in the email body, including the steps to proceed if possible.

Attach the invoice again

Make sure the invoice you are reminding your client to pay is readily accessible to them without requiring them to search through their email history.

If you are using online invoices, reattach the invoice to your email or include a link.

Mention the consequences of non-payment (only use this after multiple attempts)

What is the original intent for sending reminders? Although you want to get compensated, you also don’t want to punish your customers.

They can be ignorant of the consequences of paying late. This is your chance to remind them of what will happen if they don’t.

Confirm if the client has received the receipt

You might take advantage of the opportunity to inquire with your client about whether they actually received your invoice if this isn’t the first time you’ve reminded them.

So, it’s best if you attach the receipt and ask them if they have received it. This way, any technical snag, human error, and issues can be averted.

Use tools for scheduling emails

In order to preserve consistency, if you do decide to send out reminders at regular intervals, be sure to use a tool for scheduling emails. Sending at sporadic intervals can lead to multiple emails being sent out early, which would make recipients forget as the deadline approaches.

An automated scheduling system will be used to distribute these messages in accordance with a predefined schedule. You may avoid sending the customer too many emails at once by doing this. Instead, between the time the invoice is sent and the payment due date, they are distributed. This keeps reminding the client without giving them too much or too little notice.

A free email scheduling app like EngageBay can help you automate transactional emails and schedule them smartly so that the recipient gets the important emails at the right time.

Real-World Examples of Payment Reminder Templates

Let’s consider hypothetical examples from different industries to illustrate the application of payment reminder templates across various business scenarios. Below are case studies or scenarios showing how businesses can adapt these templates to fit their specific needs.

Case Study 1: Retail – Fashion Boutique

Scenario: A boutique sells designer clothing online and uses payment reminders to follow up with customers who have unpaid invoices for custom orders.

First Payment Reminder

A friendly email reminding the customer of their unpaid invoice, emphasizing the exclusivity of their custom order.

Subject: Don’t Miss Out on Your Custom Design!

Hi [Customer],

We wanted to gently remind you that your custom design is waiting for you. Please complete your payment of [Amount] to proceed with the order.

Payment methods and invoice details are attached below. Feel free to reach out!

Thank you

(Business Name)

Second payment reminder

More urgency, yet still polite, reminding the customer of a possible delay if payment isn’t made.

Subject: Your Custom Design is On Hold!

Hi [Customer],

We noticed the payment of [Amount] is still pending. To ensure your custom order is completed on time, please settle the invoice at your earliest convenience.

Payment methods and invoice details are attached below. Feel free to reach out!

Thank you

(Business Name)

Case Study 2: Software as a Service (SaaS) – Subscription Platform

A SaaS company offers a subscription model for its project management tool. The company uses reminders when clients are approaching renewal deadlines or have missed their recurring payments.

First payment reminder

Friendly notification a week before the subscription renewal deadline.

Subject: Your Subscription is Expiring Soon!

Hi [Customer],

Your subscription to [Service] is about to expire. Please renew it by [Date] to avoid any disruption in your service.

Payment methods and invoice details are attached below. Feel free to reach out!

Thank you

(Business Name)

Second payment reminder

Subject: Don’t Lose Access to Your Projects!

Hi [Customer],

We’ve noticed your payment of [Amount] for [Service] is overdue. Please pay by [Date] to avoid losing access to your account.

Payment methods and invoice details are attached below. Feel free to reach out!

Thank you

(Business Name)

Wrap Up

The foundation of any thriving business is a flexible internal collection procedure. It is easy to realize that you need to have a plan for contacting and collecting on past-due accounts.

The difficulty lies in carrying it out and producing clear emails that inspire action.

Any clients who haven’t paid you yet should be contacted as soon as possible. This involves sending postal mail, emails, and even SMS messages.

When creating your payment reminder emails, we’ve got you covered. Any of the samples from this blog post can be copied and used for your needs.

And if you want an all-in-one marketing, sales, and customer support solution that can remove data silos and streamline your workflows:

Try EngageBay — it’s free forever!

Content updated for freshness and SEO by Ayushi Nagalia.