For the longest time, banks and financial institutions relied on face-to-face communication for building lasting customer relationships.

Today, most banking work is done on the mobile phone or through the customer’s desktop, iPad, or laptop. Digitalization of banks and banking development services has made bank visits obsolete except in a few unavoidable cases.

This is great for everybody involved, but it comes with a pitfall. Bank managers and sales reps no longer have direct, personal access to their customers. Many customers today expect the same level of consistency and personalization from banks as they do from retail companies.

How can banks implement the digital version of an in-person meeting? The answer lies in implementing a CRM system.

Banking CRM, or customer relationship management, is how you can keep up with the changing times. While bank CRM software would find some uptake among the largest financial services firms 10 years ago, they’re virtually a necessity today. Customer relationship management — CRM — is a process through which you can keep in touch with your clients without compromising efficiency.

In this blog post, we’ll discuss how CRM for banks can help every institution in the industry, be it large or small.

Table of Contents

What Is CRM in the Banking Sector?

Bank CRM systems enable banks to implement customer-centric strategies. It does this with the help of machine learning and automation, and a whole set of software applications that can be integrated into a common workflow.

EngageBay’s Sales CRM takes care of your routine operations so that your sales team can focus on the real job.

CRM for banking acts as a unified solution for keeping records of every employee, customer, and transaction. More importantly, it can predict customer behavior and the outcome of sales pipelines, with revenue projections per product or task.

Banking CRM software can do much more — from scheduling appointments to managing leads and generating performance reports, all from one dashboard.

What Are the Benefits of CRM in Banking?

CRM in the banking industry can help banks better manage their customers and understand their needs to provide tailored financial services. It has many benefits to offer, as we’ve detailed below.

1. Increased Lead Conversion

A CRM software helps you keep track of your existing customers’ activities and enables you to create upsell and cross-sell opportunities.

In other words, it helps you sell an additional product or service to a customer, of a similar or higher value.

After all, there’s a higher probability of converting existing customers than acquiring new ones.

2. Increased Productivity

Successfully implementing a CRM solution for banking services can be marvelous for sales and employee productivity.

For starters, it can help cut costs by minimizing repetitive administrative tasks such as data entry and contact logging. It streamlines your entire operational process, keeping every person involved updated on the progress in real-time.

Thanks to the software taking up most of the work, bankers can handle more transactions in less time.

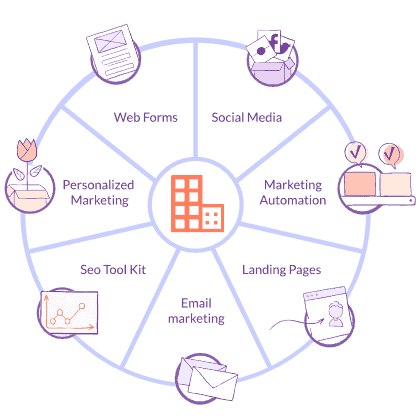

3. Better Brand Image Online

Today, marketing has come a long way from the traditional approach of billboards and newspaper ads.

Every business is going digital and trying to build an online presence across various social media platforms. Even though this allows financial institutions to reach a mass audience with low advertising costs, it has its own challenges.

People constantly talk about brands online, and one frustrated customer can ruin your brand’s reputation. Banking customers are more likely to share their bad experiences with financial services online than good ones, which can be a nightmare for bank managers.

A banking CRM software helps manage your online reputation by monitoring the web for conversations about your bank and its services. You can connect with your customers, respond to queries, and resolve any issues that come up.

4. Enhanced Communication with Customers

Banking CRM software keeps track of all conversations happening across multiple channels, including emails, calls, social media platforms, etc.

It updates the information in real-time so that any salesperson trying to talk to a potential client can pick up from the last conversation. Your sales team’s success depends on how well they understand their customer’s needs. When your sales rep has all the updated information on hand, it makes for easier communication.

Thus, every salesperson stays on the same page, avoiding any confusion and ensuring that no leads fall through the cracks.

5. Inter-Department Data Tracking

Collecting and analyzing data can help formulate business marketing campaigns, products, and services to help attract more customers.

Banking CRM tracks data from several departments, including customer service, cash deposit department, and others.

It then analyzes the data to understand customers’ needs in-depth and provide personalized services.

For instance, you can find out the top concerns of your potential clients and work on finding the right solutions.

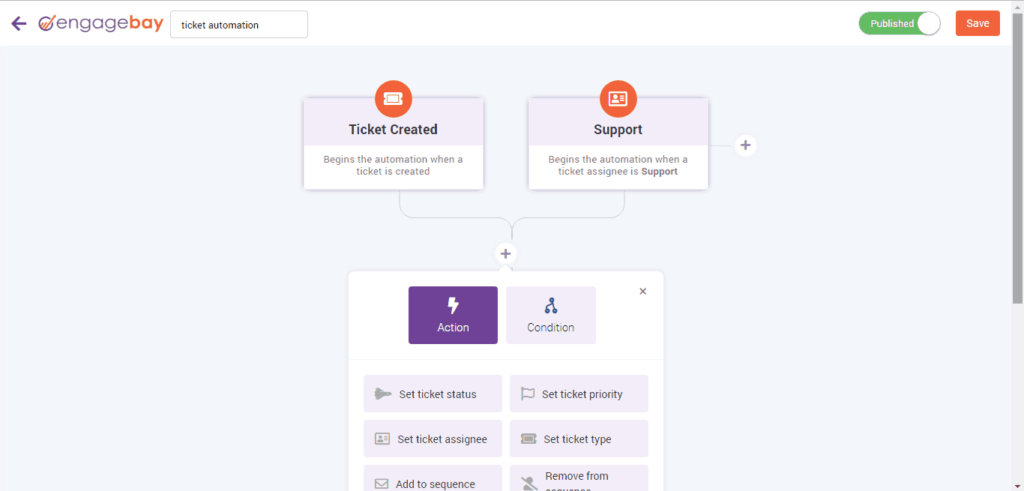

6. Increased Customer Loyalty

96% of consumers say that customer service is a primary factor in deciding whether to do business with the company again.

Great service can keep customers coming back and increase your customer retention rate.

CRM ticketing system helps prioritize the issues that need urgent response. It ensures that all customer issues are resolved at the earliest.

EngageBay offers custom ticket views that help customer support agents deliver best-in-class service.

Besides, you can use the system to personalize your response, turning problems into opportunities for better customer satisfaction. Since a CRM unifies all data on a common dashboard, it becomes easier to provide a cohesive customer experience.

Read also: Law Firm CRM: Why Every Lawyer Needs One? The Complete Guide

Banking CRM Use Cases

A banking CRM has multiple uses in different facets of business — marketing, sales, and customer service.

Banks need CRM not just to manage customer information but also to acquire more customers. Banking CRM software helps financial institutions anticipate market needs and understand the scope of improvement.

Let’s look at different use cases of banking CRM software now.

#1. Provide Personalization and New Opportunities

A CRM solution provides customer service representatives with the tools needed to provide value to their customers. This applies to the banking sector, as well.

For instance, the CRM platform can remind you of the upcoming birthdays of your customers.

The sales reps can reach out to wish them on their birthdays and offer financial services for their retirement or automated investment portfolio management.

Thus, banks can build personal connections and enhance customer experience while also increasing their revenue.

Besides, CRM enables you to offer personalized services to a large audience — allowing for faster banking and web experience to keep your customers happy. You can develop specific campaigns and increase cross-sell opportunities.

#2. Run Segmented Marketing

With increasing competition, it makes sense to provide relevant offerings and cross-sell opportunities that resonate with a group of people.

That’s why it’s crucial to segment your audience and run targeted, personalized campaigns.

There are a few solutions such as EngageBay & Microsoft Dynamics 365 that offer intelligent banking CRM software. These systems can help you to narrow down your marketing outreach to specific groups based on their interests or behavior. You can also develop targeted marketing strategies and resolve any audience-specific issues that arise.

Apart from demographic factors, you can segment customers based on page clicks, new accounts, and much more.

#3. Redefine Banking Processes

One of the main use cases of banking CRM software is that it enables you to make decisions based on data rather than your gut feelings.

It generates standardized and customized reports to give you insights into your banking operations and identify gaps.

For instance, you can easily identify which services are the most profitable and popular amongst your audience. You can then run paid campaigns online to promote those services and attract new customers.

Similarly, you can figure out which service is not working or if you should change the target audience for a particular product. Using data, you can make a concrete strategy and increase your chances of success.

Besides, it helps automate workflow across all branches. It sends out an alert when a customer hits a particular milestone and is ready for more product or service recommendations.

All this helps your sales team sell better and increase customer lifetime value.

Challenges of CRM in the Banking Industry

CRM is essential to retain customers.

With the ever-increasing demands of customers, it’s practically impossible to run a banking institution without CRM tools.

However, implementing CRM solutions has its own challenges, and the banking industry is no exception.

i. Data Security

One of the biggest challenges for banks today is data security and controlled access.

Customers trust a bank to keep their information safe. Thus, customer data needs to be protected against cyberattacks.

If the data gets leaked, it can create a bad reputation for your bank in the market. But the good news is that CRM providers are aware of these concerns and have deployed high-security measures to address them.

The banking industry is highly sensitive to data leaks and thus, needs an extra level of protection. It also needs to have access control over these records so that not every employee can read them.

Thus, modern CRM providers are instituting role-based access restrictions, encrypted transmissions, data center backups, and session time-outs, to ensure a high level of information security.

ii. Integration With the Existing Tech Stack

Another challenge of the banking institution is the integration of CRM software with the existing IT infrastructure.

Most legacy systems weren’t built to integrate with modern CRM systems.

Thus, it can be a complicated process to combine two tools that aren’t compatible with each other. The best approach here is to be upfront with your CRM vendors and ask them about the various integration options. The integrations offered must also be scalable with your evolving CRM needs.

Find out how much it will cost, and confirm if the new system will sync with your old solutions.

Related Article: Banking CRM: Top 6 Features to Get More Out of Your Clients

How to Choose the Right Banking CRM?

Even before you start shortlisting CRM providers, make a list of your requirements.

With so many options available in the market, it’s easy to lose track of your priorities.

The primary rule to choosing a banking CRM is to know what you wish to accomplish by using a CRM solution. Once that’s done, a few other factors play a role in picking the right solution.

1. On-premise or Cloud

Any CRM software can be deployed on your own server or cloud storage.

Based on the deployment method, there are two types of banking CRM solutions:

Software-as-as-Service (SaaS)

This software is hosted on your provider’s server. You get online access through a website or mobile application, or both.

The best part of a cloud solution is that it saves you the investment of upfront infrastructure costs.

Traditional System

Traditional or legacy systems are fully under your institution’s control. It is a licensed program that is placed on your server to start running.

In this case, you need to set up an IT infrastructure and have resources to maintain the system. The advantage is that it can handle a massive amount of data, but it is resource-intensive.

2. Data Import

Another important thing to consider is CRM data migration.

While integrating a CRM software with your banking system, it’s crucial that the CRM tool automatically gathers all data using its in-built import module.

The primary reason to adopt CRM software for banks is to automate mundane tasks. You don’t want to invest time in manually moving data from different systems.

Choose a CRM software that enables a quick and simple process of data import.

3. Integrations

CRM should enable seamless integration with various third-party platforms to expand its functionalities.

For instance, it’s important to connect with telephone or calling software to allow tracking of all calls and auto-update a customer’s information during the call.

EngageBay offers integrations with some of the top tools in the market, including Zapier, Xero, Sendgrid, and many others

Similarly, it needs to integrate with other systems like accounting software, your different websites, and other applications.

With custom solutions, you can discuss and specify all your exact requirements.

4. Pricing

Pricing is an important factor to consider while choosing a commercial CRM system. It generally involves the cost of the product, support and maintenance, software upgrading, and data migration.

Many customer relationship management – CRM – vendors even charge additional costs for training, onboarding or extra storage for data.

Familiarize yourself with all types of costs involved so that it doesn’t burn a hole in your pocket at a later stage. The cost of CRM in the banking sector should justify the ROI you are getting from it.

Wrap Up

Customer relationship management tools can be extremely powerful for any business today. Banks are a customer-driven industry and banking CRM software is the need-of-the-hour for customer acquisition, satisfaction, and retention. A CRM software for banks can help deliver a seamless customer experience by storing information and organizing workflows between teams.

You can find banking CRM solutions specially designed for the sector or a free-to-use all-in-one CRM platform for any industry like EngageBay.

When you’re ready to make a call on buying a CRM tool, make sure the platform addresses all your banking priorities, sales needs, and customer satisfaction strategy requirements.

To learn more about banking CRM, contact us today for a demo.

This comprehensive guide on Banking CRM is invaluable! Its insights into the necessity of CRM for financial institutions are enlightening, offering a clear roadmap for success in today’s competitive landscape.

EngageBay’s blog on banking CRM is a treasure trove of insights, guiding professionals through the strategic implementation of CRM in the banking sector. A well-crafted resource that seamlessly blends practical advice with industry expertise.

Informative read on banking CRM! It highlights the importance and benefits, offering valuable insights for industry professionals. Well done!

Fantastic insights on banking CRM! This article clearly explains its benefits and importance, making it an essential read for banking professionals.