The mortgage industry is incredibly competitive. In fact, it’s one of the most cutthroat industries out there. And if you want to stay ahead of the competition and succeed in this business, you need a way to manage your business effectively.

As a loan officer, you may struggle with managing your current workload and trying to grow your client base. With the right CRM, you can win back time and close more deals.

You need mortgage CRM to convert prospects, manage your clients, validate applications, follow up consistently, offer exceptional client service, and so much more. A regular CRM software just won’t cut it.

You need a mortgage CRM software.

In this blog post, we’ll discuss the following:

- What is a mortgage CRM software

- The benefits of a mortgage CRM software

- The features of a mortgage CRM software that can help with your business

- How to choose a good mortgage CRM software

Let’s get going!

Table of Contents

What Is a Mortgage CRM Software?

Mortgage CRM software is client relationship management software that allows real estate professionals to manage their business more effectively. A mortgage CRM software provides tools for tracking loan prospects, current clients, past transactions, and daily activities so you can stay on top of every deal in your pipeline.

Mortgage CRM systems are available as either cloud-based or desktop versions, both of which have similar features. However, cloud-based mortgage CRM systems offer more flexibility and ease of use, because they can be accessed from any location with an internet connection.

With mortgage CRM solutions, you’ll have an eye on all your clients. You can monitor their activity in real-time and receive alerts notifying you of what you should do next to guide them through the sales funnels.

By automating email follow-ups, online appointments, document sharing, and deal progress tracking, you’re always ready for the next step with a client.

For your clients, deciding to take a mortgage can be a major decision. They need to feel confident that their brokers offer the best service and expertise.

In essence, a mortgage CRM software offers tools for contact management — the lifeline of any mortgage broker.

What Are the Benefits of Using a Mortgage CRM Software?

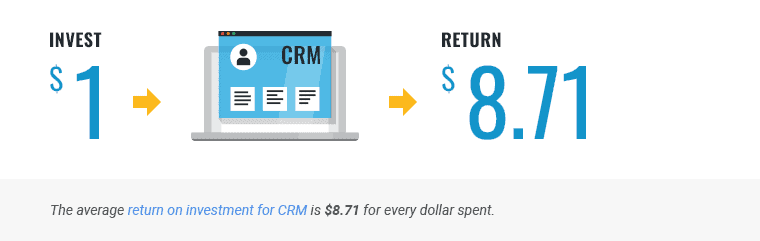

Investing in a good mortgage CRM software can have major benefits. Here are some of them:

Builds Client Trust

When a person decides they want to buy a home, this is one of the biggest decisions they’ll ever make in their lives. All the professionals they work with from the early stages of browsing homes to signing a mortgage must be trusted professionals.

Having strong client relationships can benefit you in many ways. Your clients will remember you and recommend you to their friends and family.

It builds trust and allows you to better serve your clients.

With a mortgage CRM system, you’ll have all client and property details at the ready, so anytime you get a call from a client, you can offer the right information right away. This will foster their trust in you.

They’ll learn that they can rely on you for the questions and difficulties they may have in the home-buying process.

Happy customers will also gladly take the time to review your services, leaving you glowing online testimonials that can net you even more customers!

Also read: Customer Lifecycle Management: CLM (How to) Guide for Business Owners

Better Compliance and Less Human Error

Your company’s compliance risk also drops when using mortgage CRM. With automation and more efficient and briefer processes, human error rates go down. Meeting compliance regulations is an important step in increasing the brand value of your business.

Cost and Time Savings

Who doesn’t want to save time and money? It doesn’t matter what your industry or niche is; anyone would say yes.

We talked earlier about the automation features of mortgage CRM software, but we were only scratching the surface. Here are some marketing automation features of a mortgage software:

- Email marketing with drip emails, autoresponders, email sequences

- Lead scoring and lead nurturing

- Sales pipeline reporting and forecasting

- Contact database with lead capture, contact history, notes, etc.

- Campaign management

- Web forms and landing pages

- Social media integration (for microblogging, Twitter, etc.)

You can automate follow-up emails, so it’s like you’re at your desk to respond to clients 24/7. A mortgage CRM can segment customers for you, such as young first-time homebuyers versus the second or third-time homebuyers in their 40s or 50s. This can help you tailor your services to best suit your customers.

Okay, but how do you save big money with a mortgage CRM software? Majorly by reducing instances of mortgage fraud.

Even the most experienced loan officers sometimes can’t sniff out a bad deal until it’s too late. What’s worse is that mortgage fraud is becoming more common than ever in 2021, says Tim & Julie Harris Real Estate Coaching.

Their site mentions a stat from CoreLogic. In the first quarter of 2021, CoreLogic found that mortgage fraud went up by 11.9 percent. That’s dangerously high!

Mortgage fraud can be very detrimental for loan officers and their companies.

Consistency and Productivity

The process of receiving a loan request and granting it will never be completely consistent due to outside variables such as processing times, collecting relevant documentation, and more. Yet mortgage CRM software can introduce more consistency to the process, and that makes quite a difference!

Through workflows, automation, task management, roles, and delegation features, you can improve efficiency while also maintaining consistency.

With less downtime between receiving a loan application and processing it, more customers might choose your mortgage company because of your faster turnaround times.

This reduces downtime, meaning there’s less time between applications and processing. People, in general, don’t like to wait and so this can immensely improve customer satisfaction.

Also read: CRM Database: Overview, Structure, Strategies & Maintenance Tips

Predictive Reporting

The analytics of mortgage planner CRM is among the top reasons why it’s so valuable for loan officers. The frequent and deep reports the mortgage CRM produces will showcase more than just earned income: it will paint a clearer picture of what your loan officers are doing right — and what needs changes.

As the reports identify room for improvement and gauge your performance, you can streamline the mortgage process. This is another great way to keep your clients happy.

Mortgage CRM Features for Loan Officers

Let’s get into detail about some key mortgage CRM features that can make life much easier for loan officers.

Cloud Portal

Cloud-based mortgage CRM is the way to go, especially for smaller businesses. Though larger businesses may have in-house mortgage CRM systems to manage their work, SaaS CRM software has multiple benefits over traditional ones.

For starters, the maintenance and other responsibilities go to the vendor. All you have to do is make a purchase and enjoy the tools.

You can also access all your information from anywhere, anytime.

The online cloud portal also helps your clients interact with you directly without the need for physical meetings. This is especially important and useful in a pandemic-ridden world. Above all, it offers another avenue for customer satisfaction and improves ease of use.

Many mortgage CRMs have mobile applications as well to help you manage your work on the go.

Here’s a video that explains how you can integrate your CRM software with your Loan Origination Software (LOS):

Social Media Features

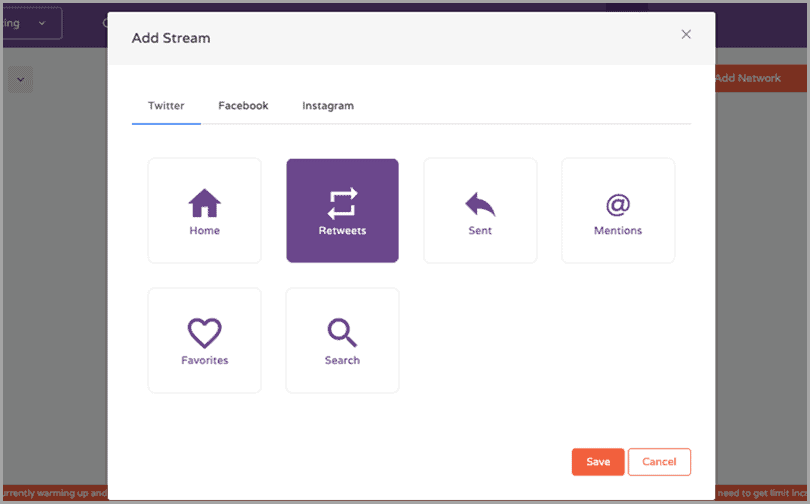

Everything and everyone is on social media these days, and that includes your CRM software as well. In between customer loan applications, you can check your mortgage CRM for mentions of your company on social media platforms.

Social media has become a mainstream mode of communication these days. Even professionals and businesses use it to reach a wider audience and offer another channel for communication.

With tools such as EngageBay’s Social Suite, you can manage all your social media accounts — LinkedIn, Facebook, Twitter, and Instagram — all without ever having to leave the platform.

You can look out for mentions, answer customer queries, and even use social listening to find out what your audience is talking about you (and your competitors).

Your company might then decide to implement changes based on this feedback. For instance, if your customers are complaining that their requests aren’t being handled expediently enough, you might tweak your automated workflow within your CRM to increase loan processing speeds without sacrificing accuracy.

Integrations

Your mortgage company is likely heavily reliant on a handful of software applications. You could log into one program after another throughout your day depending on which part of the loan process you’re in.

You have to wait for the software to load, log in, do what’s necessary within the software, log out, and then log into another software. These tasks chew up more of your day than you realize!

If only there was another way…

There actually is! Many mortgage CRM vendors including EngageBay offer integrations to help you connect with your favorite applications. With this feature, you can use other tools all from one place, thus saving time and improving efficiency.

You’ll only have to sign in to the CRM and then you can access your favorite email platform, your social media tools, your eCommerce app, and any other software your mortgage company needs.

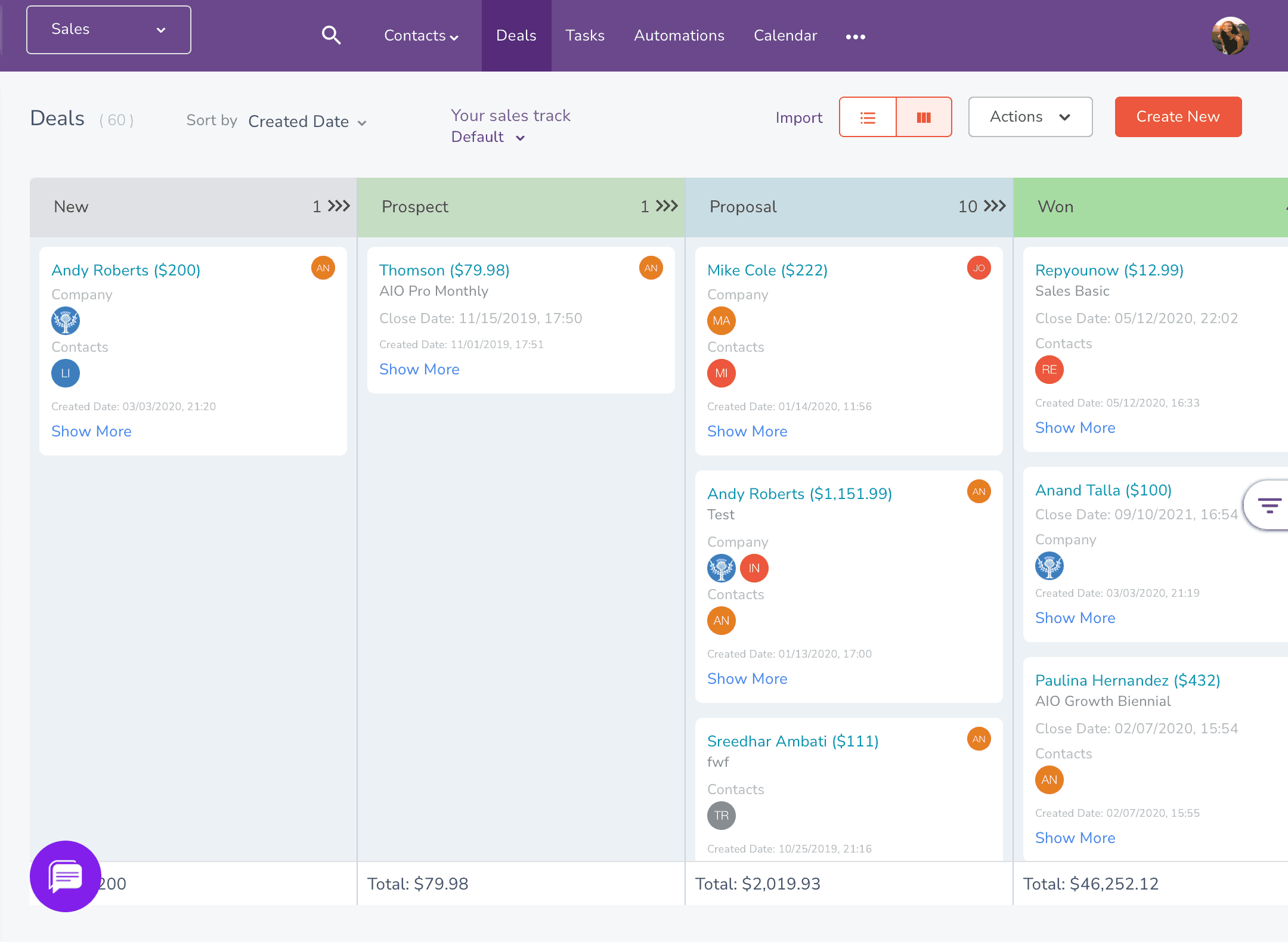

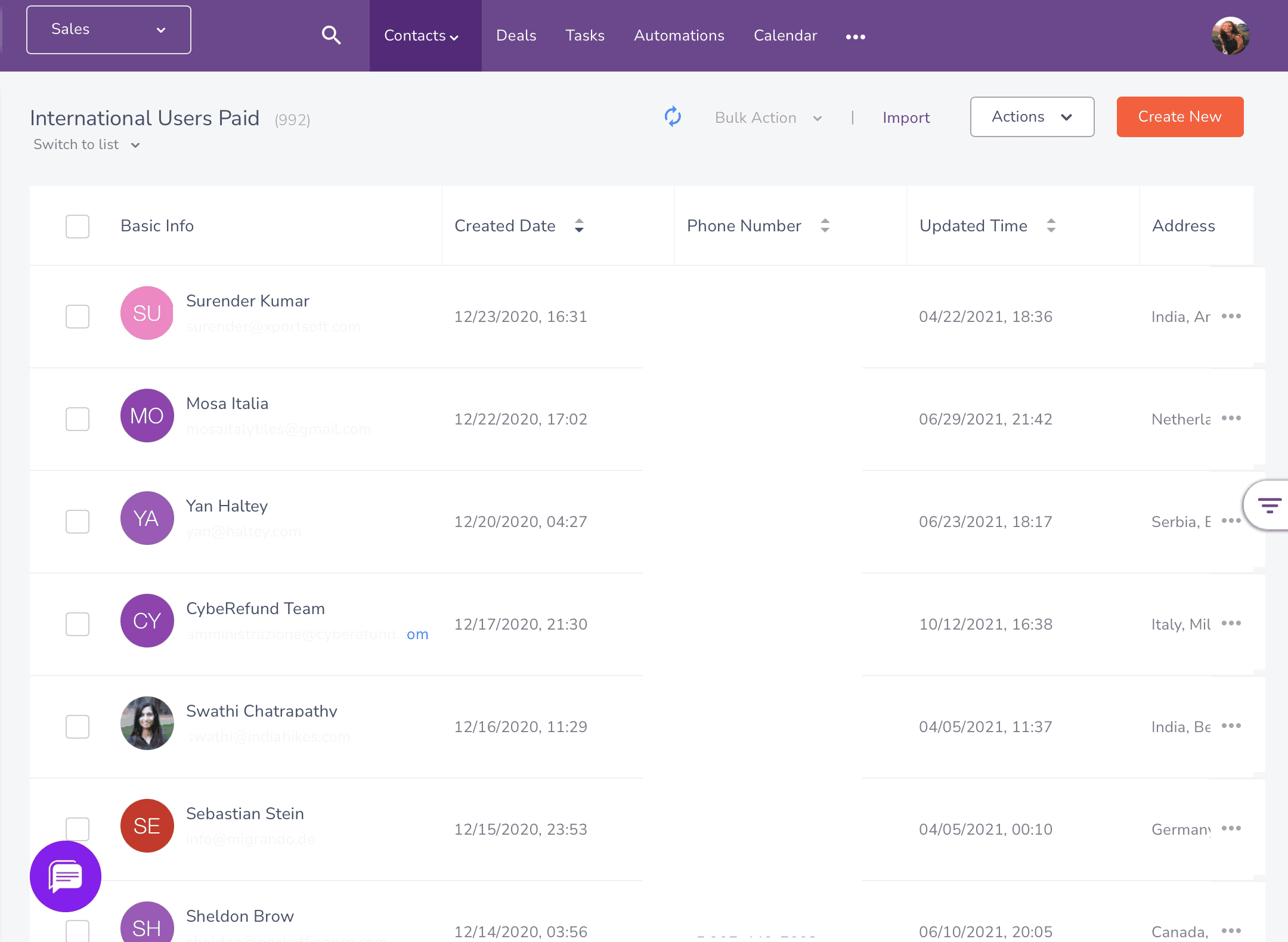

Contact and Loan Management

Without having a proper contact and loan management solution, everything will descend into chaos. Fortunately, a mortgage CRM software has contact management and segmentation, project management, deal pipelines, and workflow automation to help you break down and streamline even the most complex processes.

Many CRM solutions let you import your preexisting contact lists from programs such as Microsoft Excel. You’ll have all the details on your active and past clients in one convenient place, including their contact information and their current loan status.

As you and your fellow loan officers interact with clients, your CRM can log these interactions from various sources, including phone, email, and chat. This vital information is stored in a centralized database and can be accessed and updated accordingly.

Having this information is handy for other loan officers who might work with the same client. They can quickly review the information on the client and determine where in the loan process this client is.

Tracking the loan process from its beginning stages until it’s eventually closed is easy within CRM, as data is synchronized in real-time.

Also read: Operational CRM: A Complete Guide (+7 Best Operational CRM Software)

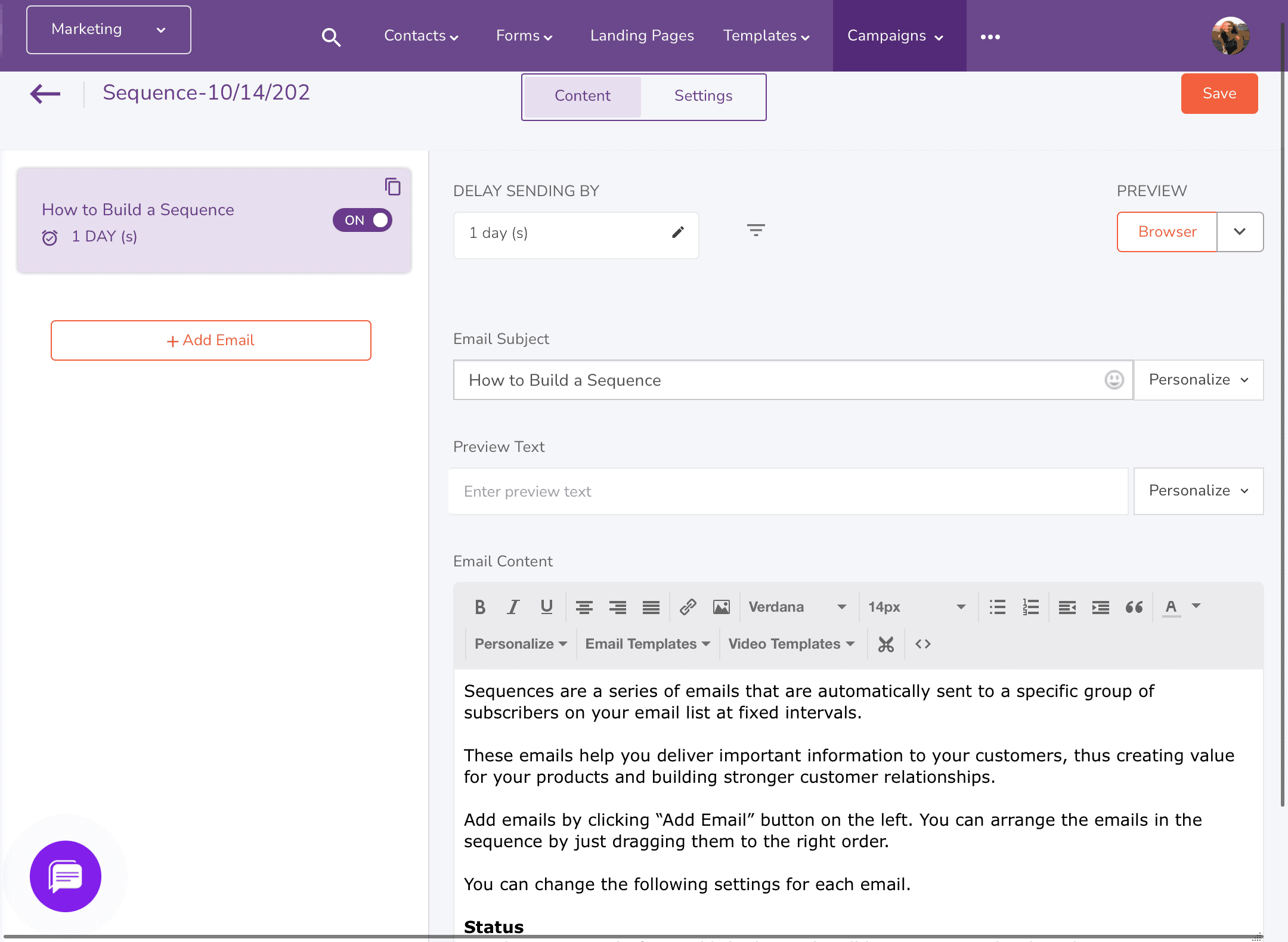

Drip Mortgage Marketing Campaigns

As a mortgage company, having an outreach program is integral if you want to increase your leads among your customer base. The best way to send drip emails as part of that campaign is through CRM.

As we mentioned before, buying real estate is no small task. People don’t go shopping for houses overnight, which means you can’t convince people with just a single email.

That’s where drip campaigns come to play. You send out regular emails with tailored information and engaging content over a long period.

Mortgage CRM software offers tools, such as customizable email forms, smart segmentation, personalization, and email sequences to help you launch powerful campaigns that slowly convert mortgage loan borrowers.

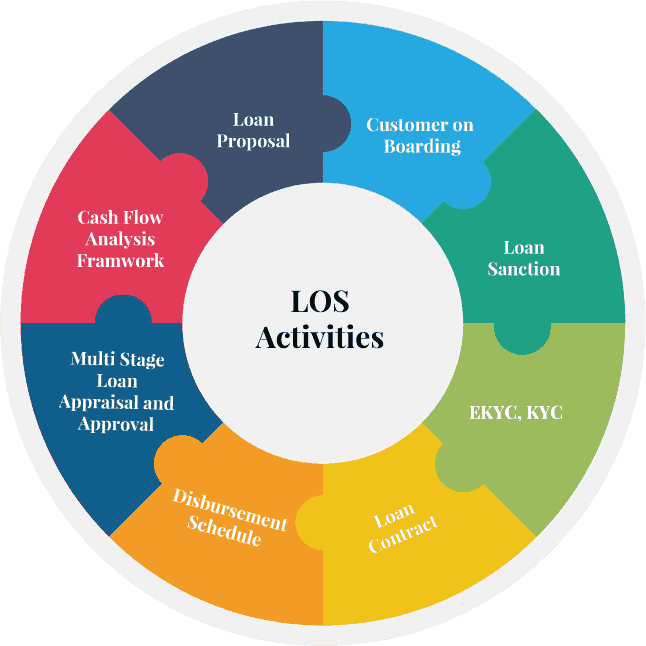

LOS Integration

A Loan Origination System (LOS) is a mortgage platform that processes mortgage transactions from origination to completion once the application is completed. It offers seamless management of documents, pricing, third-party interfacing, credit pull functions, compliance agreements, and other internal processes. Also nowadays various credit builders, such as Digital Honey and others, are becoming more and more popular.

Though LOS software help manage the actual loan process, it is an ineffective tool for lead capture and nourishment, customer management, and sales. That’s the role of CRM software.

Integrating a LOS system with your existing CRM software is crucial for loan officers.

A good mortgage CRM software has LOS integration so that data and information can seamlessly move between the two platforms. This means you can set up automation in your mortgage CRM software to start upselling and cross-selling when a loan application is processed in the LOS software.

Scalability

Scalability is an important factor for growing companies. You need to be able to expand your contact lists, add tools, and upgrade your packages easily as your company grows. But changing your vendor or software to suit your business’s growing needs is complicated, ineffective, and expensive.

That’s why mortgage CRM software such as EngageBay makes it extremely easy and transparent, so you can focus on upgrading your software without having to worry about hidden costs.

How to Choose the Right Mortgage CRM Software

Now that you’ve seen the benefits of a mortgage CRM software and what it can do for your lending business, the question remains: how do I choose one that fits the best for my company? Here are some great pointers for you.

Know what you want: Keep a lookout for a CRM software that has the features mentioned above. You can also choose one that has features that your particular company needs. For mortgage lenders, that’s loan pipeline management, loan reports, web-based customer portal, LOS integration, integrated compliance modules, partner marketing, among others.

Take advantage of free trials: Free trials or demos are there for you to decide firsthand whether a particular mortgage CRM software is the right fit for you. Most vendors offer free or at least a trial version.

Choose software that’s easy to use: This tip may seem like a no-brainer, but you’d be surprised! Some companies get lured in by low prices or plentiful features and are willing to ignore the fact that their CRM is clunky or confusing. If you and your team can’t easily use the CRM, then all the time-savings benefits we discussed earlier are as good as gone!

Check that it integrates with the tools you use: You know the tools that are a part of your routine as a mortgage lender. Before you commit to a CRM, double-check that it has as many relevant integrations as possible. After all, it’s great when a CRM solution integrates with Zapier or WordPress or Mailchimp, but if you don’t use those tools, then who cares? These integrations won’t help you at all.

Decide a budget: Throughout all this, you and your team must have a CRM budget. Then try to stick within that budget, which is sometimes easier said than done. All it takes is some cursory research to discover that a lot of CRM software solutions are quite expensive!

What is the best mortgage CRM? For small businesses, EngageBay is a great CRM software without a doubt. EngageBay is a free mortgage CRM software with features such as appointment scheduling, tasks, visual loan pipeline management, contacts, and marketing.

Conclusion

Loan officers spend hours on the phone each day. A lot of this communication and documentation is time-consuming and repetitive.

You can use CRM software like EngageBay to automate daily tasks, reduce human error, boost the loan processing rates, and enhance customer satisfaction.

This will give you an edge over the competition and help grow your client base.

The mortgage industry is a competitive one. Not only are you competing with other mortgage lenders, but also with real estate agents and title companies for your client’s business.

Our free integrated CRM will give your mortgage company the tools you need to shift gears.

EngageBay offers a powerful CRM software that helps close deals faster while reducing costs associated with manual tasks like lead management, follow-up emails, lead marketing, appointment scheduling, multi-channel marketing, sales automation, and much more!

For as little as your daily coffee spend, you can use a tool that can transform your business.

Sign up today and take your business to new heights!